Crown Commercial Service frameworks

We are proud to have been awarded a place on four of the Crown Commercial Service (CCS) frameworks, so we can use our innovative solutions to support the public sector.

We have been awarded a place on the following frameworks

Vertical Application Solutions: RM6259

This framework (Lot 1) provides access to business application software to support with revenue and benefit solutions, payment processing, cash receipts and civil enforcement, it is available to all public sector organisations.

Debt Resolution Services: RM6226

The Debt Resolution Services (Lot 3) framework provides access to debt recovery solutions and affordability assessment to ensure fair outcomes and support for vulnerable consumers, it is available to all public sector organisations.

G-Cloud 13: RM1557

The G-Cloud 13 (Lot 2) framework provides cloud based services for central government, charities, education, health, local authority, blue light, devolved administrations and British overseas territories.

Digital Outcomes 6: RM1043

The Digital Outcomes 6 (Lot 1) framework provides access to agile development and user-centred design services to accelerate innovation within the public sector, it is availble to central government, charities, education, health, local authority, blue light and devolved administrations.

Explore our range of products designed to cater for the public sector

Why choose Aryza

We provide highly targeted automation solutions for public sector. They bring together all the components you need to effectively engage with customers, support them and provide qualitative assessments at scale. These include blending all required internal and external components and solutions to create a single configurable solution for you.

Using our solutions will help you reduce onboarding and management costs for a range of solution providers; for example SMS providers, anti-money laundering, credit reference, open banking and asset valuations. They will also provide a consistent platform for consumer financial assessment, collections. recovery and ongoing consumer support.

Our solutions bring together all of the data sources and functionality you need to engage, monitor and assess customers in a financial and regulated environment, and they can be integrated into your existing solutions.

Aryza Recover

Aryza Recover is a modern collections solution that provides you with a highly configurable web and mobile optimised platform. It engages with the consumer and helps them to provide a financial assessment, manages their treatment options, tracks vulnerability and optionally can take payment.

In the background Aryza Recover offers a powerful and highly configurable CRM and content management system which drives configurable collection strategies for a variety of treatment cases.

Security and simplicity are strong considerations within Aryza Recover, so it securely guides the consumer through the assessment journey: invitation; identification; open banking or manual fact-find; import of credit bureaux data; presentation of income/expenditure against industry guidelines; Q&A for further insight and guidance on affordability and best outcome, for example, repayment arrangements, payment breaks or advice.

Benefits include:

Improve your collections rates and promises to pay

Increase customer engagement across multiple devices

Overlay the latest digital solution to existing in-house systems

Increase customer care and support

Fully measure and test customer engagement and outcomes

Own the customer experience and journey

To find out more, contact us to arrange a call with our CCS lead

Aryza Monitor

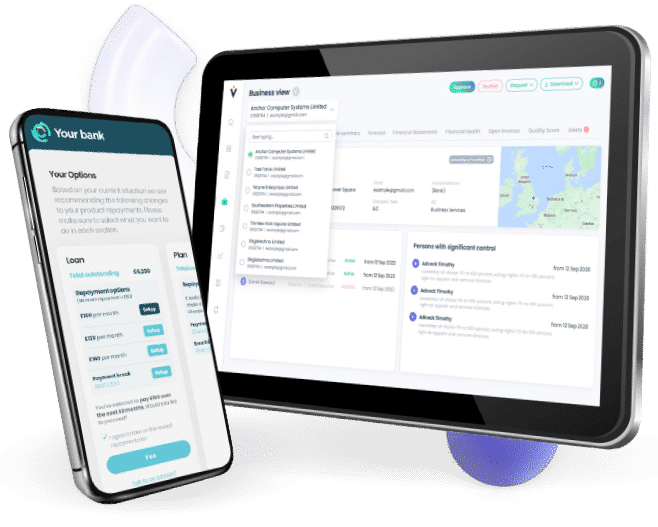

Aryza Monitor provides live insights on SMEs via the use of open ledger and open banking technologies to help you lend, assess, monitor and collect. These data sources are interpreted by Aryza Monitor and then presented to you in an understandable format.

By simply providing the CRO number and connecting Aryza Monitor to the SMEs accounting platform and bank accounts, Aryza Monitor can automatically retrieve all the required accounting and banking data, apply powerful algorithms and present the outputs in a series of intuitive dashboards with drill-down capability. This reduces the time and effort spent by you and your team gathering information and helps deliver a self-serve relationship with your customer.

You can carry out a financial health check on the SME for decision making, then easily explore the P&L, balance sheet, cashflow and financial KPI’s. Compare different historic periods to determine changes in financial performance and volatility. This platform can also be easily integrated with case management systems.

Benefits include:

Quickly understand the SME financial profile and resilence

Reduce and manage credit risk including fraud

Monitor ongoing performance and be alert to deviations

Reduce operational and supplier costs with increased digital efficiency

A full assessment, blending key financial tools in one area

Make informed credit decisions, monitor and collect

Import SME customer files, integrated with most major accounting packages and banks

To find out more, contact us to arrange a call with our CCS lead

Aryza Advize

Aryza Advize is a software platform designed for the financial services market and used by those engaged in the activity of assisting and advising individuals. You will have access to the platform via cloud based servers.

The platform provides a suite of tools for customer onboarding, case management and engagement. Customer onboarding includes marketing integration with multiple work streams via API, data file upload or user case creation. Workflows manage case progression with omnichannel communications including SMS, email, Aryza Messenger (an instant messaging and document management app), and letter generation. Electronic signature capture is built within the software.

Aryza Advize integrates Open Banking, allowing you to communicate with consumers through instant messaging, allowing you to verify ID, pull Credit reports, Bank Statements and Anti Money Laundering checks. You can automate client queries and speed up the document gathering process to seconds.

The management of formal and informal debt solution cases are achieved by status driven campaigns, to seamlessly progress the case through the journey. This allows bespoke timelines based on the consumers profile and behaviour to run effortlessly in tandem. Dynamic protocol compliant insolvency templates are completed, generated and delivered with a click of a button.

Benefits include:

Engage directly and digitally with a consumer

Pull in all information to manage a consumer case centrally

Build agent workflows and diary management

Import consumer contact lists or build manually

Provide affordability and repayment advice

Manage and evidence consumer vulnerability

Exchange and store data and electronic documents

Provide electronic signature and other integrations to support engagement

To find out more, contact us to arrange a call with our CCS lead

Get in touch

"*" indicates required fields