Explore the future of insolvency case management with our end-to-end solutions

With over 20 years’ experience in creating software solutions for the debt and insolvency industry across the globe, we understand the many challenges and complexities involved with helping individuals and businesses navigate financial difficulties, so we built the solutions to help

Would you like to see our end-to-end debt and insolvency case management solutions in action?

Simplified case management for enhanced efficiency and productivity

In the dynamic Canadian financial landscape, navigating the complexities of insolvency requires a comprehensive and streamlined approach. The Aryza suite of products offer a transformative force, tailored specifically to the Canadian market, offering an end-to-end solution for Licensed Insolvency Trustees. They work seamlessly together to revolutionize insolvency practices across Canada.

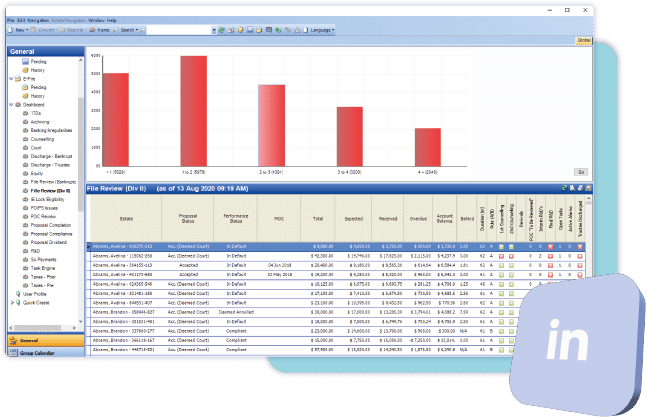

Aryza Advize redefines case management with its intuitive platform, simplifying every facet of insolvency practice. From effortless data capture to simple integration with existing systems, Aryza Advize ensures compliance while eliminating manual tasks. Its customizable nature allows for tailored solutions to fit individual practice requirements, fostering consistency and efficiency. Aryza Advize not only enhances productivity but also strengthens client engagement through personalized communication and proactive follow-ups, all while providing actionable insights to drive continuous improvement.

In conjunction with Aryza Advize, Aryza Insolv forms a seamless partnership, ensuring the smooth transfer of lead information and eliminating data duplication. Aryza Insolv integrates flawlessly with Aryza Advize, facilitating a consistent and compliant approach to case management. Together, they create a cohesive ecosystem that empowers Trustee productivity and fosters regulatory adherence, ultimately optimizing the insolvency process for all stakeholders involved.

Aryza Engage completes the picture by enhancing client engagement and relationship management. Through personalized SMS and email notifications, Aryza Engage keeps debtors informed and engaged throughout their debt resolution journey. Its omnichannel approach ensures consistent communication, while proactive follow-ups and automation nurture relationships and improve conversion rates. Aryza Engage empowers Trustees to maintain strong client relationships, ultimately driving success in their insolvency practices.

Want to learn more about the benefits our solutions bring to the debt management and insolvency sector? Speak to us today

Our debt management and insolvency products

Efficiencies through integration

The integration of Aryza Advize, Aryza Insolv, and Aryza Engage creates a unique symbiotic relationship that maximizes efficiency and effectiveness.

By working together, these platforms provide Trustee practices with a comprehensive toolkit to navigate the insolvency landscape with ease. From initial client interaction to case resolution, Aryza’s suite of solutions empower Licensed Insolvency Trustees to thrive in a complex and challenging financial environment.

These tools represent the future of insolvency management in Canada, offering a holistic approach that streamlines processes, enhances client relationships, and drives success for Trustee practices nationwide.