Automating the collation of information for Insolvency

Speak to a member of the team to find out more about Aryza Review

The management of customers in an IVA can present real challenges to an Insolvency Practitioner.

It is crucial that accurate information is gathered on a regular basis to ensure the agreement is managed effectively.

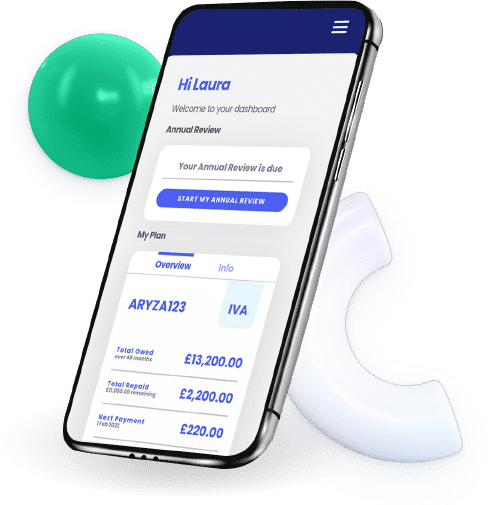

Aryza Review gives your customers access to an automated tool that can be used to gather personal and financial information to give an accurate view of affordability and vulnerability.

It can also suggest areas for money saving, based on the Standard Financial Statement guidelines (SFS), and includes a decisioning element to provide your customers with an outcome of the best course of action for them.

Benefits to the consumer

Simple Email or SMS invite

Secure registration and login

Secure document upload

Automated contact strategy

Automated contact strategy

Household information

Automation of information collation

Validated against SFS guidelines

Pre-populated with previous data

Summary of financial situation

Benefits to the Insolvency Practitioner

Automation of complex data gathering

Saves time – reallocates core resources

Reduces costs

Automation of customer communication

White labelled solution – increase conversions

Quick implementation

Find out more about Aryza Review, download our brochure now

Aryza Review – automation of the collection of data for insolvency

Aryza Review has been designed to leverage the best practices of our clients and the requirements of consumers. Even if you have an existing automated solution it may be worth talking to Aryza about your low conversion rates and customer retention. Our experienced team will be able to work with you to review where you can improve processes, introduce efficiencies, and influence key operational SLAs.

60%

Monthly appointments in the UK personal insolvency sector managed on Aryza software

60%

Consumers prefer to complete Annual Reviews via a digital option rather than speaking with an agent

Contact us

"*" indicates required fields