100 Days Consumer Duty – Has the FCA requirement already brought about a change?

According to the FCA, many firms have embraced a customer-centric approach to comply with the regulation’s requirements.

More and more companies are using data and insights to place themselves in their customers’ shoes, seriously considering the outcomes they deliver for customers, and making real improvements to their products and services. The FCA acknowledges that this has required significant effort and represents a true shift in both practice and culture.

However, there is still much work to be done:

▶️ The FCA found that 7.4 million people unsuccessfully attempted to contact one or more of their financial services providers.

▶️ 3.6 million people were able to contact one of their financial services providers but could not obtain the information or support they desired.

▶️ Only 41% of adults had confidence in the UK financial services industry.

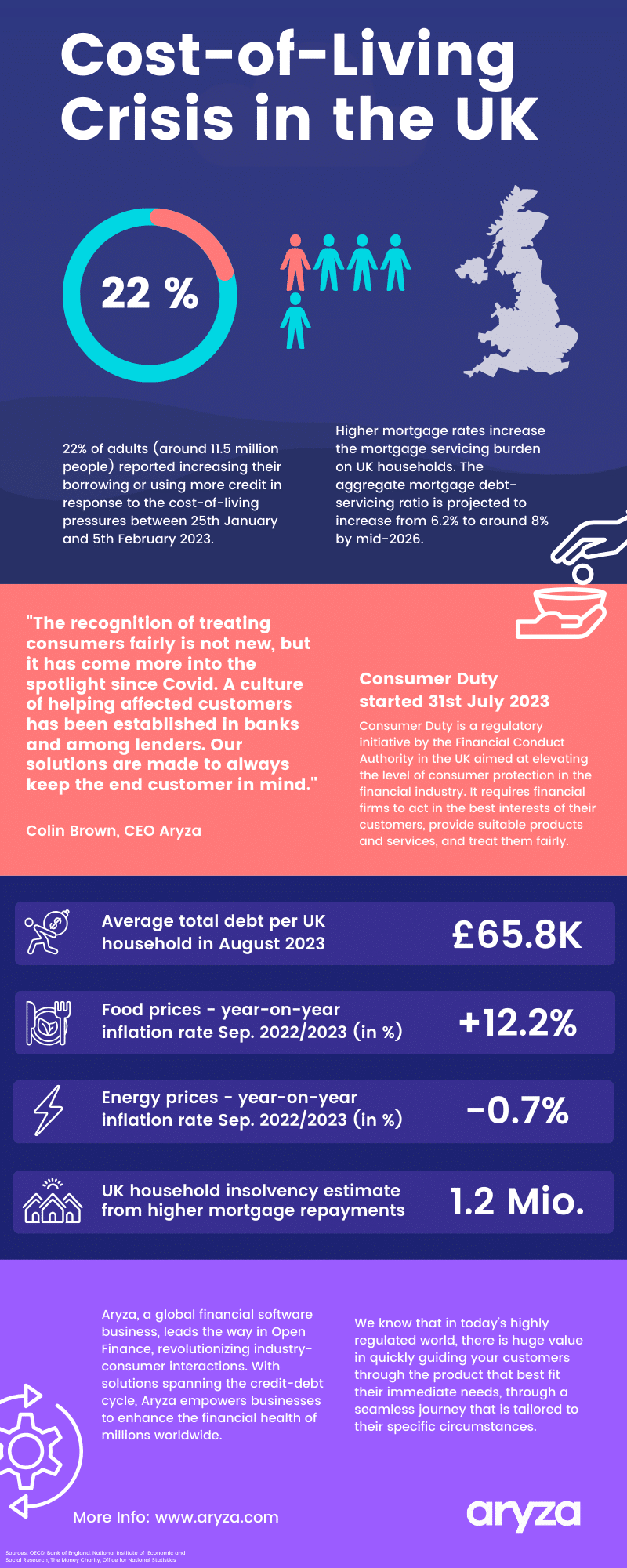

It is also clear that the cost-of-living crisis is still ongoing, and consumers are under pressure.

Intelligent and consumer-friendly communication with borrowers and debtors is of the utmost importance to achieve the best possible results in these times. Aryza systems can help with customer focused lending platforms and consumer friendly accounts receivable systems.