Conversational AI Built for Credit and Collections

Automated, empathetic, and compliant customer engagement across digital channels at scale

Speak to a member of the team to find out more about Aryza Engage

Conversational AI for regulated credit & collections

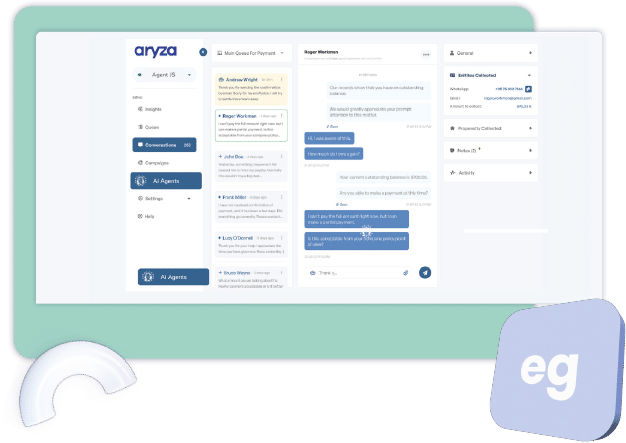

Aryza Engage is a powerful AI-driven communication platform designed specifically for credit, collections, and arrears management. It enables two-way messaging with customers via WhatsApp, SMS, web chat and more – helping organisations improve engagement, reduce agent workloads and ensure compliant, personalised customer journeys.

By combining conversational AI with automation, self-service and intelligent agent support, Aryza Engage transforms the way creditors interact with customers in financial difficulty – while improving outcomes at scale.

The platform also offers a digital annual review module, enabling seamless customer engagement for Income & Expenditure (IE) reviews. This bolt-on solution integrates with existing case management systems to streamline document collection, reduce operational effort, and improve the customer experience – all in line with SFS Guidelines and Consumer Duty requirements.

Aryza Engage is built to reach more customers, keep them engaged, and move them to positive outcomes; automating conversations and collecting payments with maximum efficiency.

Blends Self-Service with Agent Handover

Channel Flexibility

Built for Credit and Collections

Improved Business Outcomes

Better Customer Engagement and Experience

Efficiency Without Increasing FTE

Integrated Document Collection & E-Signatures

True Conversational AI, Not Just Bots

Configurable, Compliant Workflows

Maintain Compliance

Real Results with Aryza Engage

Here’s what our clients are achieving with conversational AI:

Over 70%

increase in customer engagement

Up to 90%

reduction in agent handling times

380-420

daily closed conversations vs 50-70 phone calls

Up to 76%

increase customer/ payment wins

FAQ

Aryza’s AI is pre-trained using our Custom Collections Language Model, built specifically for credit, collections, and payments conversations. It is out-of-the-box ready to use from day one, with no need for technical setup or training on your side. And as you use it, the AI learns from your conversations — so it continually improves based on your own customer data and outcomes, becoming even more effective over time.

Aryza Engage uses a Custom Collections Language Model — not a general-purpose AI like ChatGPT. It’s trained specifically for credit and collections conversations, so it only responds with pre-approved messages, never generating content freely.

Our platform uses credit-specific language models and pre-approved response frameworks to ensure all interactions meet ethical and legal standards. We take data security very seriously, it is woven into everything we do. We are ISO27001 certified, GDPR compliant and we are in the process of securing SOC2 certification for Engage, Aryza are currently SOC2 certified. Our solution is a cloud hosted solution hosted on AWS and we have been certified by AWS as following best practice for data security.

Aryza Engage provides agents with real-time response suggestions, summarised conversation histories, and alerts for key events. This reduces mental load, increases accuracy, and allows agents to focus on meaningful interactions. On average, voice agents handle 50–70 conversations per day, whereas Aryza Engage agents manage 380–420 conversations per day, dramatically reducing FTE requirements.

Yes – the platform includes a fully integrated digital IE journey and e-signature capabilities. Customers can complete annual reviews anytime via web portal, including document uploads and electronic signing. Workflows are fully configurable and include automated triggers to keep customers on track. The tool integrates easily into your existing case management system.

Contact us

"*" indicates required fields