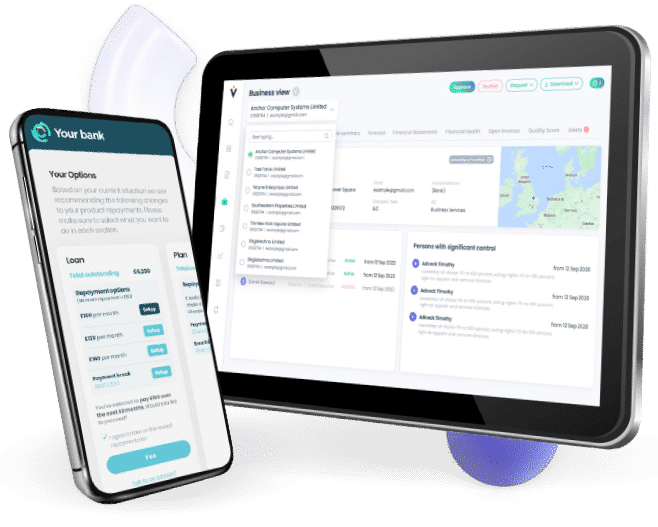

Lending solutions built to accelerate and automate the full loan lifecycle

Our cloud-hosted platforms support the entire lending lifecycle, from application through management and onto collections when necessary. Lenders can benefit from a holistic view on one single platform, facilitating the smoother running of operations and resulting in greater customer satisfaction.

Our lending solutions can sit alongside, or independent to, any platforms already being used to manage existing loan customers.

Simplifying and automating vehicle finance management

We take time to understand your needs, and your customers’ needs. Our range of products have been built to support you through all stages of the customer journey; from acquisition and selecting the right plan through to ongoing management of a lending book, and help in dealing with payment plans and arrears strategies.

Credit Card Application Software

Automation and rules-based decisioning for credit card applications, particularly in relation to managing affordability and vulnerability.

Automate and simplify the credit card journey for you and your customers

From automating the application process and user journey to managing client communications and managing defaults and arrears, our credit card services software makes managing the full credit card journey easy and efficient.

Other lenders

Lending software delivering automation and rules-based decisioning for secured or unsecured lending, personal loans via alternative lenders, peer-to-peer loans, short term loans, guarantor loans and more

We take time to understand your needs, and your customers’ needs, from automating the application process and user journey to managing client communications and managing defaults and arrears, our lending software makes managing the full credit journey easy and efficient.

Mortgage providers

Mortgage management software to give you a comprehensive view of affordability and vulnerability, prior to offering a loan.

Rules-based decisioning means that part of the application process can be safely automated, with customers enabled to securely provide critical mortgage information via digital platforms.

We have tools that can help customers who are struggling with repayments, as well as automating some payment break management and arrears processes.

Retail lending

Embedded finance solutions for interest free, buy now pay later, and interest bearing products.

Our retail lending solutions have been developed in partnership with some of the biggest names in lending – and our multi-lender, embedded credit broker solution which has been implemented with a category-leading retailer in the UK.

The UK market is defined by the competing forces of traditional retail credit providers (Hitachi Credit, Creation, Barclays Partner Finance etc) competing with global tech giants like Klarna and Affirm, but there is also a wide range of smaller specialists who are thriving in carefully targeted markets. Aryza is positioned in this ‘multi-lending’ space as a specialist retail lending origination’s software partner.

Solutions our software is for

Benefits

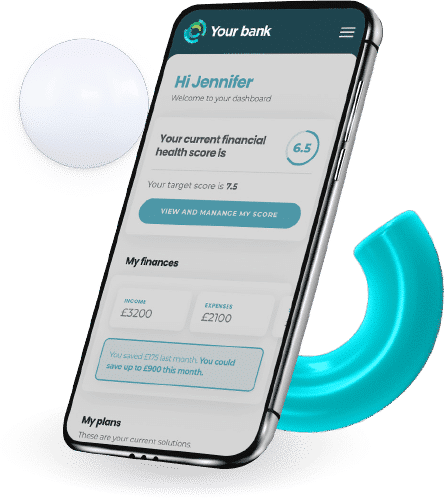

Ethical, end to end solutions to help you manage the whole lending journey

For lenders, there are many benefits to having an integrated digitised loan management system. We’ve listed some of the key advantages of loan management software below, but this list is certainly not exhaustive:

Streamlines processes

Reduces reliance on paper documents

Minimises errors

Provides a superior customer experience (increased customer retention)

Easily assure compliance with automated processes

Offers scalability (provides tools to grow)

Predict revenue more accurately

Offers greater risk control