Cloud-based decision engine to automate lending decisions and manage your credit risk in-house

Speak to a member of the team to find out more about Aryza Decide

Download our interactive brochure here

Powerful lending decision engine

Simple and easy to use, our comprehensive decision engine puts you in control of your credit risk and lending decisions.

Aryza Decide allows you to create a rules-based customer journey, that integrates into your current workflows to deliver results quickly. The platform is controlled by you so your internal team can efficiently make changes to products, pricing and risk profiles, reducing underwriting time.

The platform easily integrates into your existing workflow, and by embedding credit reference agencies, open banking and open finance providers, ID&V and AML checks into your rule sets, you can reduce your credit risk and manage your scorecards and decisions in-house.

Our simple and easy to use decision engine gives you full control of your lending decisions across multiple products

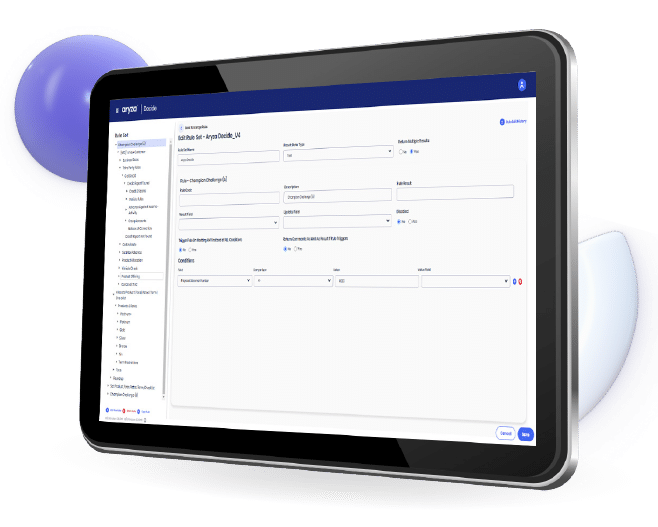

Rule sets

Create comprehensive rule sets using a simple interface that allows you to easily manage your decisioning rules in-house

Scorecards

Create and tailor your scorecards to manage the rate for risk across multiple products using your pre-defined rules

Decisions

Use a combination of rule sets and your bespoke scorecards to define your decisions on a product by product basis

Integrations

Easily integrate CRAs, open banking providers, ID&V and AML checks into your rule sets to reduce risk and speed up underwriting time

A standalone platform that allows you to bring new products to market quickly, and manage the credit risk journey in-house

You’re in control

Create rules sets

Cost reduction

Various integration options

Simple UX

Speedy processing

Full service

Contact us

"*" indicates required fields