Case Study – BDK

Bank Deutsches Kraftfahrzeuggewerbe (BDK) – a specialist auto finance bank serving the motor vehicle trade and part of Société Générale – set out to streamline its receivables management processes: from gaining a structured overview of all relevant data to introducing automated, team-specific task lists and more efficient interfaces with service providers.

Since going live with Aryza Collect in October 2024, BDK has been managing its processes entirely digitally. Staff now access receivables and partner data centrally, work with prioritised task lists, and benefit from standardised workflows. As a result, the receivables management function has become noticeably more efficient and transparent.

About the Client

Bank Deutsches Kraftfahrzeuggewerbe (BDK) is a specialised auto finance bank and trusted partner to the German motor vehicle trade. It provides car dealers and their customers with a range of financial services, including vehicle financing, leasing solutions, and insurance products. In addition, BDK supports dealerships with inventory and working capital financing, as well as digital tools to streamline financing processes.

Founded in 2000 and headquartered in Hamburg, BDK employs nearly 600 people and works with around 3,400 dealer partners across Germany. The bank is part of the Société Générale Group.

Project Objectives

BDK aimed to improve work allocation within its receivables management operations.

Key goals included providing fast, structured access to all relevant receivables and partner master data, along with activity data, through a well-organised user interface in Aryza Collect. The bank also wanted to reduce or mitigate system disruptions between applications.

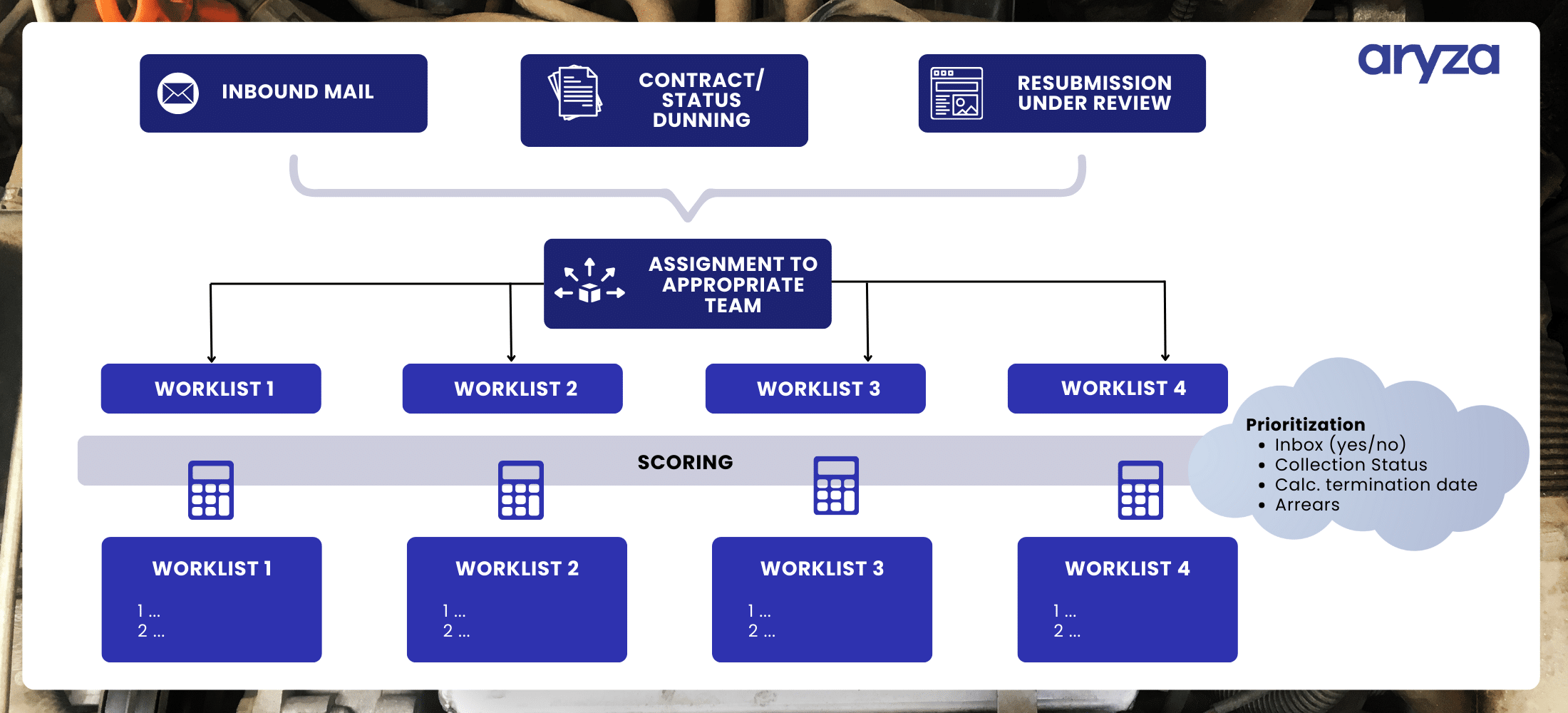

Inbound and outbound tasks were to be prioritised using scoring models and automatically assigned to teams based on relevance. In addition, BDK sought to streamline interfaces with service providers and automate data transfers wherever possible, ideally using event- or rule-based triggers.

Receivables Management Structure at BDK

BDK’s receivables management is structured according to the receivables lifecycle, with dedicated teams handling everything from early arrears through to contract termination, debt recovery, and the realisation of collateral.

Software Implementation

Following an initial feasibility study by Aryza, the implementation phase began.

This included:

- Connecting relevant BDK source systems and configuring interfaces to external service providers

- Designing and implementing a tailored roles and permissions framework

- Creating a BDK-specific user interface and team allocation logic for processing accounts and receivables

- Implementing customer-specific workflows, such as the monitoring of payment agreements

- Conducting targeted training sessions for both technical and business user groups

Post Go-Live with Aryza Collect

The system went live on 14 October 2024.

Since then, BDK’s receivables management team has been working with team-specific task lists, prioritised based on criteria such as dunning status and outstanding balance.

For example, a team may receive a prioritised “Phone Collection Worklist” instructing staff to contact selected customers and seek to establish a payment arrangement.

Each team works with dedicated task lists designed to fit its specific responsibilities. These worklists are automatically sorted in descending order of relevance and processed accordingly.

The diagram below illustrates how contract criteria, team assignment, and task distribution are coordinated. These processes are fully automated within Aryza Collect.

Another key objective was to optimise and automate the transfer of accounts to external service providers in full compliance with data protection regulations. When certain criteria or events are met — such as a deadline expiry or returned mail — relevant receivables or account records are selected and automatically transferred to the appropriate service provider via a system interface.

With the go-live, we have reached another important milestone. Not only can we decommission two systems as planned, but we have also taken receivables management in leasing to a new level, advancing in terms of prioritisation, process standardisation and automation. Particularly noteworthy are the significantly improved data transfers to our external service providers.

Head of Operations

Customer Feedback

The consolidated and clearly structured presentation of receivables and partner master data from multiple source systems saves staff considerable time when searching for case-relevant information.

In addition, the need to switch between the core banking system and the document management system has been significantly reduced. Key efficiency gains stem from the implementation of standardised processing workflows and system-integrated customer communications — some of which include predefined follow-up dates.

BDK’s receivables management team has been working exclusively with Aryza Collect since going live and continues to collaborate closely with Aryza to develop and implement further process and system improvements.