Capital Analytics: Greater Transparency in Capital Use

Turn static allocations into informed decisions – with clear insights into risk, capital requirements, and optimisation potential.

Speak to a member of the team to find out more about Aryza Comply

Change the dynamic

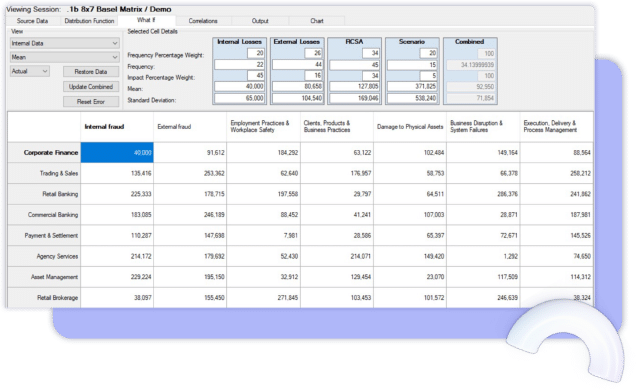

For many business lines within financial services firms, conversations about regulatory capital and economic capital can sometimes feel one way. Each year they are simply told the capital assigned to their business, and they can have little understanding as to how they might lower that capital number for the following year. This often happens because risk teams don’t have the tools they need to provide additional insight. Aryza Comply – Capital Analytics enables firms to have more business value-centred conversations around capital.

Enable proactive conversations

Aryza Comply – Capital Analytics enables the operational risk team to give the business the ability to see clearly why their capital numbers are what they are, and have informed discussions with operational risk teams about the impact of changes to risk exposure and control effectiveness.

With Aryza Comply – Capital Analytics, organisations can:

Risk-Adjusted Capital Allocation

Strategic ‘What If’ Scenarios

Capital by Loss Type

Performance by Capital Use

Capital-Risk Appetite Alignment

Flexible Data Inputs

Capital Charge Comparison

Risk-Capital Relationship Insight

Contact us

"*" indicates required fields