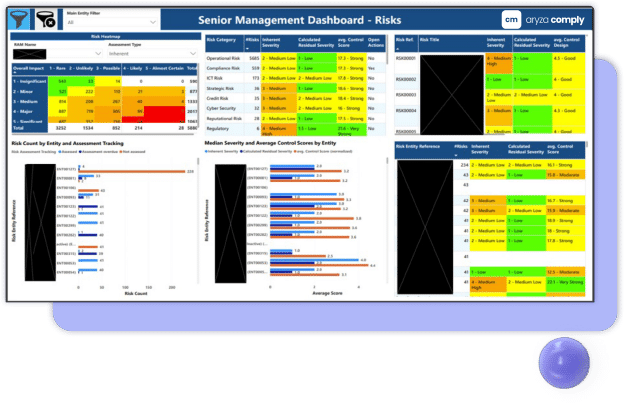

Enterprise Risk Management: Turn Risk Data into Actionable Insight

Enterprise risk data is only valuable when it’s accessible, integrated, and actionable. By combining automated data collection with powerful analytics, organisations gain the clarity they need to manage risk proactively and make confident decisions.

Speak to a member of the team to find out more about Aryza Comply

Working with ERM data

Gathering and analysing enterprise risk management data – both quantitative and qualitative information – can sometimes seem like an overwhelming task. Aryza Comply – Enterprise Risk Management helps firms automate data collection. For example, workflow tools speed collection of qualitative information, while APIs process KPI metrics. Data about all risks, including liquidity risk, credit risk, profitability risk and reputational risk, can be analysed quickly and easily.

Make good decisions with GRC Intelligence

Managing enterprise risk well within financial services organisations isn’t just about collecting data – it is also about analysing that data and sharing insights across the business. Aryza Comply – Enterprise Risk Management enables firms around the globe to create true GRC Intelligence from enterprise risk management data – it is a solution that takes an integrated approach to data capture, analytics, and reporting.

With Aryza Comply, organisations are able to:

Automate KPI Collection

Unlock GRC Intelligence

Unify ERM Data

Connect Risk and Resilience

Monitor Limits Proactively

Link Risk Appetite to Action

Close Risk-Related Issues

Contact us

"*" indicates required fields