Debt & Insolvency

Software designed to automate and simplify debt & insolvency management to guide people back to good financial health

We have 20 years’ experience working with the majority of the UK debt and insolvency market and therefore understand the impact of debt on consumers as well as the complex regulatory framework surrounding this industry, so we built software that addresses and manages both.

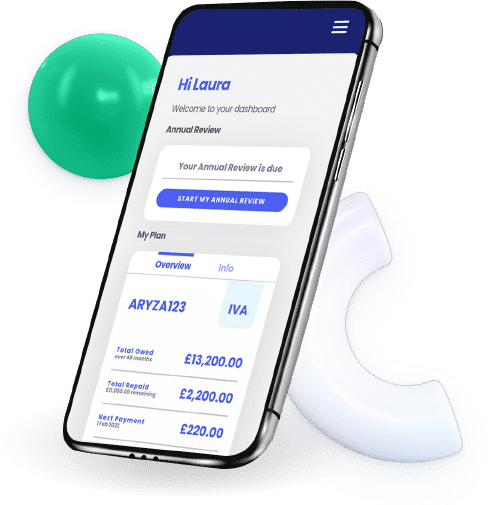

Debt management software

Debt can have a significant impact on mental health and quality of life. We built debt management tools to make the journey back from debt a smoother and more efficient one.

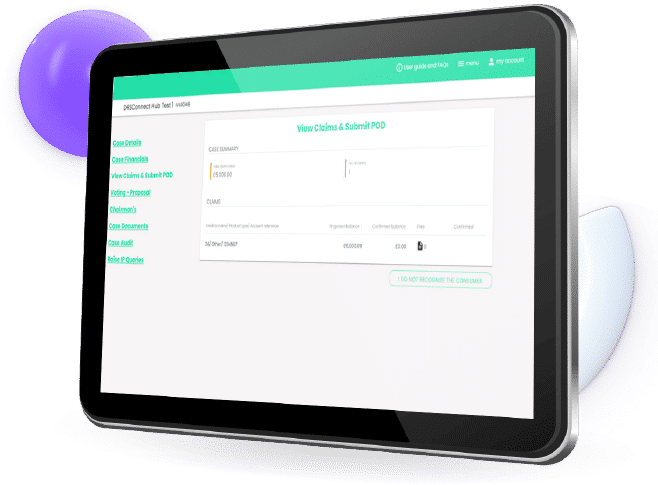

Insolvency Practitioners Software

Providing you with the insolvency software to automate and simplify the complex insolvency journey, for full compliance, better engagement, and improved customer outcomes.

Aryza debt & insolvency in numbers

450,000

consumer cases under Aryza management

100,000

new cases per annum

£1Bn

expected return to creditors

£6.75Bn

total debt