Mastering Receivables Management: A Guide to your personal Multi-DCA Strategy

Welcome to our comprehensive guide on maximizing success in receivables management through the powerful approach of a multi-DCA strategy. In this blog, we will delve into the intricacies of using multiple debt collection partners (DCAs), unlocking benefits that include cost reduction, increased repayment rates, and enhanced customer loyalty.

The Power of a Multi-DCA Strategy

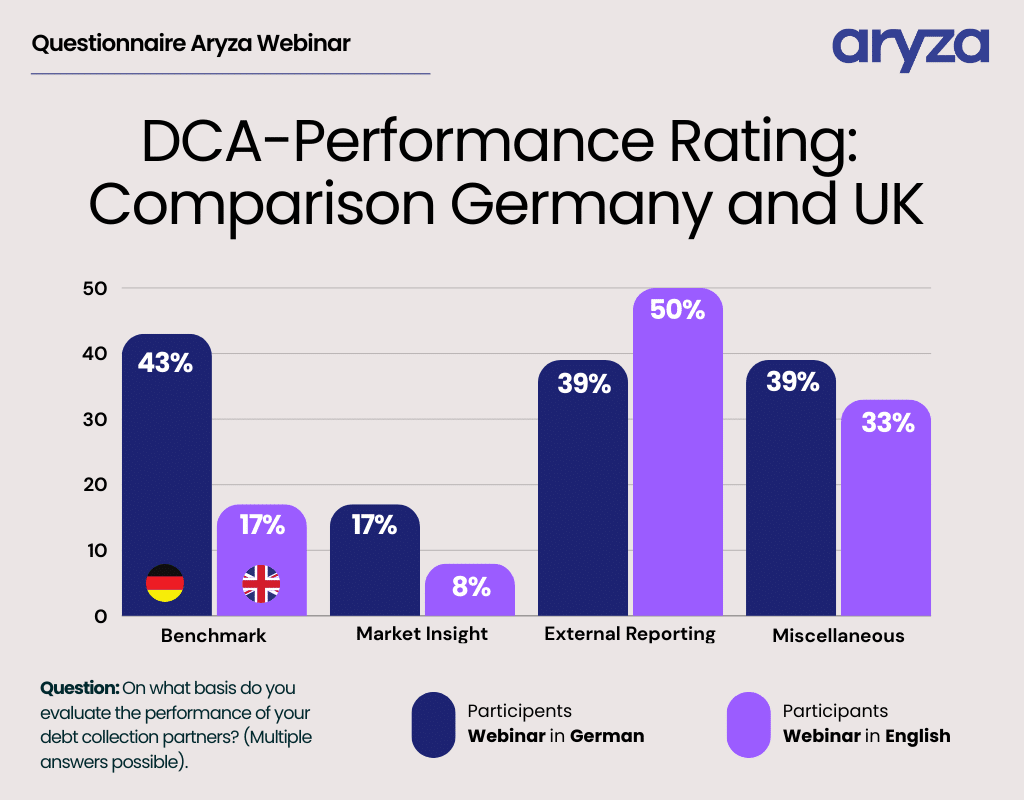

A multi-DCA strategy involves employing multiple collection partners, providing the opportunity for benchmarking and A/B testing.

There are multiple advantages:

- Increased Gross Collection Rate: Experience shows a 3% boost in the gross collection rate when utilizing multiple partners.

- Improved Operational Performance: Shorter case durations, no cases in arrears, and a streamlined process from handover to cash inflow.

- Enhanced Negotiating Position: By comparing performance, you gain insights that strengthen your negotiating position and offer an exit strategy if a partner underperforms.

- Diversification: Allocate your portfolio strategically, optimizing resources based on partners’ strengths in handling different types of collections.

Customer Centricity and the “S” in ESG

The inclusion of “customer loyalty” emphasizes the importance of fostering positive relationships with end-customers, even in debt situations. This approach is crucial for long-term success for two reasons:

- Continued Partnership: In markets where customers frequently switch providers, maintaining a long-term strategy builds lasting partnerships and increases the likelihood of customers returning.

- ESG Considerations: Aligning collection strategies with Environmental, Social, and Governance (ESG) goals positively impacts society, meeting evolving expectations shaped by social media and regional legislation. ESG values can be reflected in KPIs, such as costs for customers and the percentage of cases in the judicial phase. Regulatory changes underscore the need for adaptability and ongoing evaluation of service level agreements.

Segmentation of customers and debtors

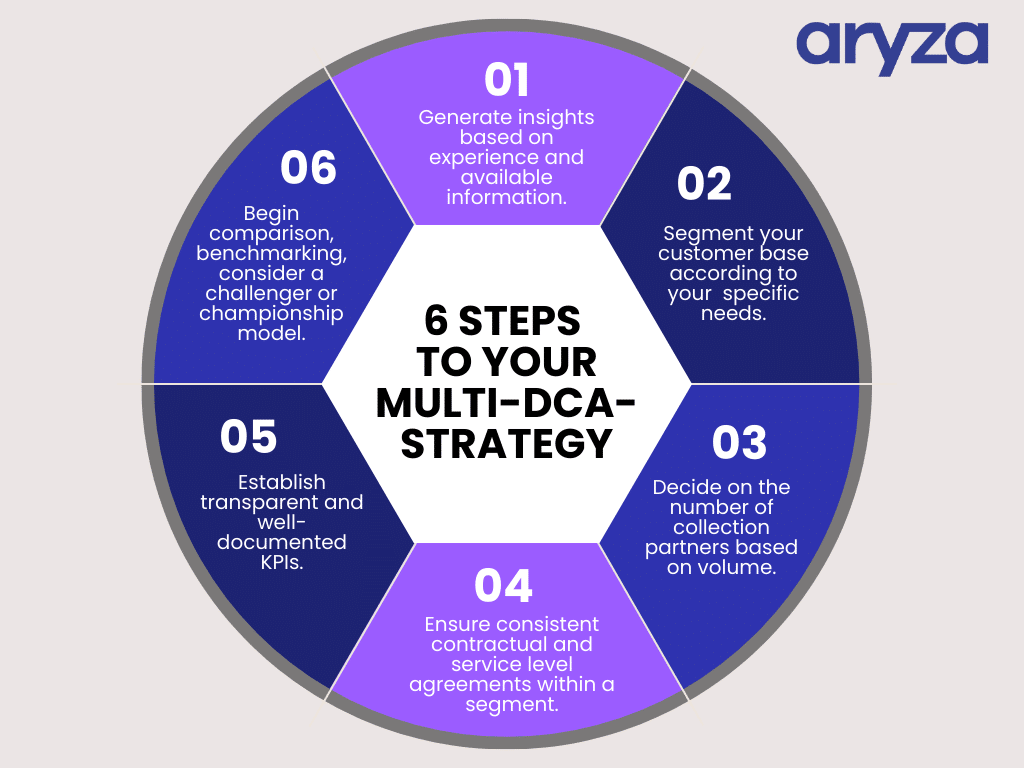

Segmentation is vital for tailoring strategies to different customer groups. Practical steps include:

- Generate Insights: Use experience and available data to understand customer behavior.

- Create Segments: Tailor groups based on specific needs, considering factors like volume and type of collection. From our experience, a multi-DCA strategy becomes beneficial from around 100 cases per month, ensuring a reasonable distribution of cases between partners.

- Set KPIs: Transparent Key Performance Indicators (KPIs) for each segment facilitate comparison and benchmarking. Collection rates are crucial, but operational KPIs like cases in arrears, cases at a standstill, and average case duration provide a more comprehensive view of a collection partner’s performance.

INFOGRAPHIC: Multi-DCA-Strategy of RheinGold Bank

Data Comparability

While different DCAs may prepare data differently, the effort to make them comparable is worthwhile. IT challenges should not prevent working with multiple DCAs; various tools and partnerships can ease the process.

Convincing multiple DCAs to provide comparable data involves emphasizing risk spreading, continuous improvement, and framing the collaboration as mutually beneficial. This guide simplifies the process by offering insights into the benefits of a multi-DCA strategy.

Conclusion

Implementing a multi-DCA strategy requires effort in contract and IT alignment. However, the benefits, including a 3% increase in gross collection rates, streamlined reporting, and adaptability to regulatory changes, far outweigh the challenges. This guide serves as a valuable resource for enhancing the efficiency of receivables management, promoting success in an ever-evolving debt collection landscape.