Government financial software to automate the acquisition and monitoring of customers, arrears, recovery and consumer engagement

Your customers face a difficult financial time, the rising cost of living puts increasing pressure on consumers and forces them to make difficult decisions on paying their bills.

Aryza provides the tools to enable you to make things easier for them. You can help customers to quickly understand their financial situation, and allow them to make better choices and feel more in control of their personal finances.

Empowering consumers to take control of their finances

The Aryza suite of government financial software helps build a more accurate picture of personal circumstances, and the level of vulnerability.

This involves assessing income and other debt commitments, and, using this data to construct a repayment agreement that is affordable.

Aryza tools can also identify stress points in the consumer’s regular finances and help avoid the demand for payment at particularly difficult times.

These tools provide a long-term solution to indebtedness and allows your customers to build a manageable pathway out of debt. In particular they support vulnerable consumers to avoid creating problems that local authorities are trying to resolve in the support of vulnerable individuals.

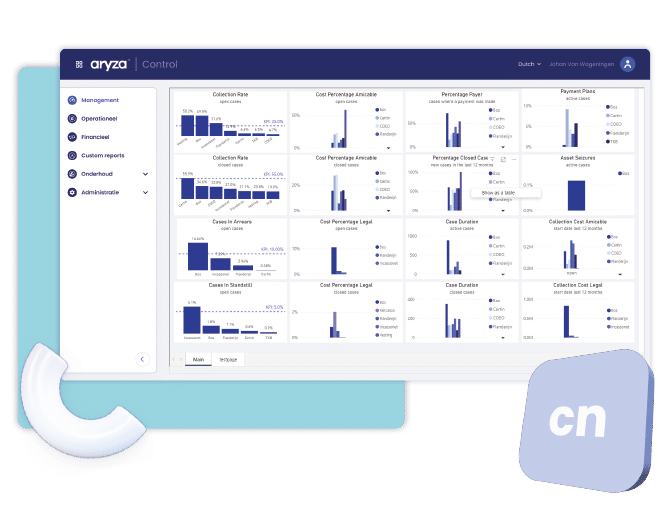

There are financial benefits for local authorities adopting a more sophisticated and responsible debt collection system

Using data from credit bureaus and open banking to tailor the approach to each consumer’s circumstances.

Aryza’s tools have shown that collection rates increase whilst demand on social services is reduced, as indebted consumers are helped to get back on their feet.

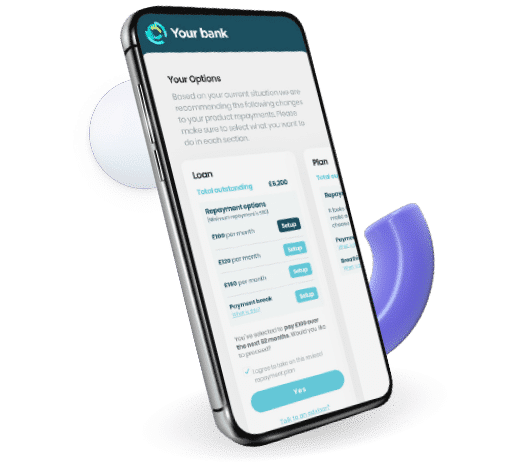

All our products are available in secure interfaces that let consumers deal directly with you via their mobile device, PC, or tablet. They can be accessed 24/7 and can automate your existing processes and workflows.

Aryza tools use a simple interface, presenting customers with simple questions and making it easy for them to submit information via open banking or manually to provide an accurate picture of their financial position.

The systems are built to require minimal integration, so you will typically be up and running in a matter of weeks without putting any pressure on your in-house IT resources.

The key benefit for a local authority is that the need to use enforcement agents with potentially vulnerable people can be dramatically reduced, whilst collection rates increase using low cost digital channels.

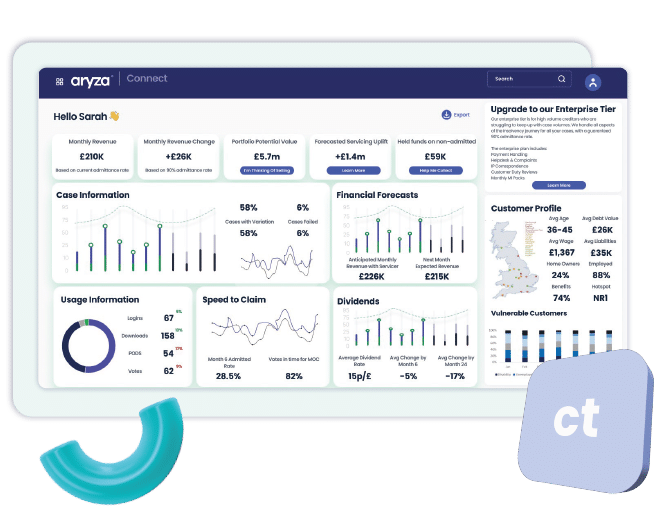

Helping consumers understand their finances and providing help with budgeting

Aryza products will help customers that are struggling with their finances and provide you with the tools to monitor and record their progress. As they go through the customer journey you will want to give them as much support as you can, and Aryza Engage allows you to give your customers additional support and guidance to improve their financial position.

Benefits

- Help your customers to save money on bills, and check for any extra benefits they are entitled to.

- Tailored dashboards give a unique view of each consumer’s financial situation.

- Provide your customers with services beyond your core products, perceived as added value.

- Help to educate and guide your customers so that they can have a more positive relationship with money.

- Retain your relationship with your customers post their insolvency arrangement, by providing useful financial tools that guide them to a better future.

Helping you understand affordability and working with consumers to build repayment options

With local authorities facing budget constraints, debt collection has become a key issue. Council tax arrears combined with adult social care debt and housing benefit overpayments, has created an estimated £5.2bn of debt remaining uncollected by local authorities. Most local authorities use of enforcement agents to collect these arrears, although this approach is considered a very blunt tool for solving the problem and does not always provide the wider solutions needed to address the underlying debt issues people face.

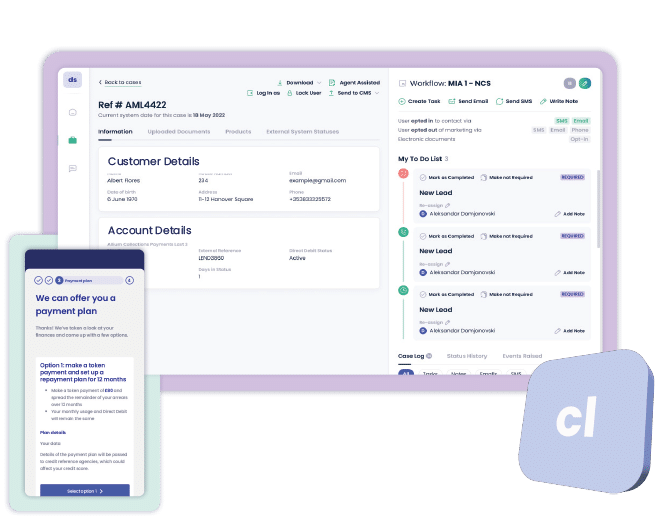

Aryza Recover lets you help consumers get back on track with their payments in an inclusive way that takes affordability and vulnerability into account.

Benefits

- Collections journey remains entirely in your control.

- Reduction in the requirement for collections staff.

- High rate of engagement with customers compared to traditional collections methods.

- Customers able to self-serve at a time they want and using their preferred device.

- Agent interface allows an assisted journey if required.

How our system works for local authorities

Use your own brand – give your customers a trusted area to share data

You can customise the messaging, logos and branding to make the application fit in with your user journey.

Ask the consumer questions that are important to you

You can tailor questions very simply to get a full view of affordability and identify vulnerability.

Receive payments and update your own systems

The ability to pay off balances or to set up structured plans is in-built to our systems allowing your customers to manage their own situation based on your rules.

Give customers additional services

As part of the solution your customers are given access to their own budgeting and money saving dashboard.

Affordability defined with a standard approach

The consumers financial details are converted into a Standard Financial Statement (SFS), the benchmark of consistency in gathering and analysing data.

Provide solutions 24/7

Using a digital approach means your customers can be presented with options based on their own unique situation.

Speed to Market

Our collections and engagement platforms are typically available within 10-12 weeks for testing.

Operation Efficiency

A single seamless and standard customer process to maximise engagement and reduce the reliance on contact centre teams.