ESG Management: Turn ESG Goals Into Action

Managing environmental, social, and governance (ESG) responsibilities requires more than ambition—it demands structure, insight, and accountability. RiskLogix’s ESG Management platform enables organisations to embed ESG into their core GRC practices, aligning metrics, standards, and strategy to drive meaningful, measurable outcomes.

Monitor performance and engage proactively

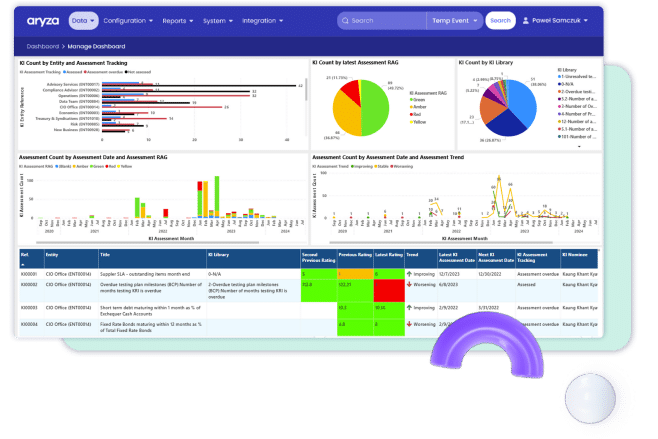

Track ESG performance at multiple levels using real-time dashboards, predictive modelling, and automated alerts. Monitor key indicators, respond to breaches with pre-defined mitigation plans, and align ESG actions with business-wide targets.

Evaluate supplier ESG performance and assess third-party compliance using embedded supply chain management tools. Automate vendor-specific reviews, audits, and periodic disclosures, and collect web-based incident data from your supplier network.

Integration with third-party systems enables you to benchmark ESG performance across peer groups, access industry data (such as climate or human capital indicators), and enrich your reporting.

Unify ESG Strategy and Operations

Define and manage the full ESG universe, including goals, risks, metrics, and standards. Align material topics with ESG frameworks, policies, and business lines.

Measure What Matters

Build a library of ESG metrics with automated indicators and thresholds. Aggregate data for reporting and disclosure, with customisable visualisation tools.

Stay Compliant, Avoid Greenwashing

Compare ESG exposure with qualitative and quantitative appetite. Ensure auditability and consistency to avoid reputational risk.

Automate ESG Assessments and Actions

Assess material topics, related threats, and mitigants with built-in scoring and workflows. Trigger remediation plans directly from assessments and monitor progress.

Manage ESG in the Supply Chain

Map suppliers to ESG objectives, requirements, and material topics. Run assessments and capture incidents through secure online forms.

Accelerate ESG Reporting and BI

Automate ESG reporting and alerts with predictive analytics. Build dashboards for stakeholders with granular, user-specific access.

Bring clarity and structure to ESG strategy

Whether your goal is to meet regulatory expectations, respond to investor pressure, or enhance long-term sustainability, our platform allows you to build a clear and consistent ESG framework. Define your business universe by country, business line, or policy area, and map material topics to applicable ESG standards, regulations, and internal objectives.

Easily manage and monitor ESG objectives, threats to material topics, mitigants, incidents, metrics, and actions—all within a centralised, configurable system.

Use flexible assessment tools to evaluate ESG maturity, run detailed risk analyses, and trigger automated workflows based on your unique thresholds and indicators. You can link policies, objectives, and metrics back to material topics and standards, ensuring every ESG decision is traceable and auditable.

Case: Leading UK Based Investment Manager

Case: Leading Global Financial Services Firm

Case: Major Global Banking Institution

A leading UK based Investment Manager with over £22Bn in funds under management implemented Aryza Unite and migrated from another GRC supplier. The migration was carried out seamlessly with minimal to zero disruption.

The firm is using the Aryza Unite widely within the organisation and utilise the functionality for a large number of GRC activities.

These include:

- Reporting and escalation of dealing errors using the Incident Management functionality

- Compliance Monitoring

- Compliance Thematic Reviews

- Compliance Breaches

- Internal Audit Reporting

- Regulatory Horizon Scanning

- Policy Exception

- Product and Service Reviews

- Third Party SLA Breaches

- Data Breach Analysis and Escalation

- Risk and Control Testing

This deployment demonstrates the wide potential of Aryza Unite to provide significant value across a wide spectrum of GRC activities and showcases the deep functionality and flexibility inherent in the system.

Despite the challenges of a rapidly changing regulatory environment, a leading global financial services firm has successfully implemented Aryza Unite, migrating from their legacy GRC system.

The firm identified a clear opportunity to enhance their GRC processes to meet more stringent regulatory requirements while improving operational efficiency. The Aryza system and team were chosen as they wanted to implement a market-leading and dynamic platform supporting a diverse range of GRC activities including incident management, risk and control assessments, key risk indicators, compliance and policy management.

The system needed to deliver more efficient risk management with effective and consistent risk assessment and reporting capabilities to support the firm’s operations across multiple jurisdictions. Utilizing its experienced team of GRC experts, coupled with its unique mix of modern, adaptable software, Aryza delivered a phased approach to implementing an enterprise-wide solution that automated processes, eliminated silos, and improved ease of use and efficiency.

The platform has led to significant improvements in incident management, risk assessment quality, and reporting capabilities, enabling the firm to respond more effectively to regulatory requirements

A major global banking institution with operations in over 30 countries implemented Aryza Unite to standardize their risk management approach across all regions. The company needed a solution that could accommodate varying regulatory requirements while providing consolidated group-level reporting.

The initial scope of the project was to implement the Risk and Control Assessment (RACA) module to create consistency in how operational risks were assessed across the organization. We delivered a configurable RACA process that allowed for local customization while maintaining group-wide standards. The system’s flexibility enabled the company to apply different risk assessment matrices for different business units while rolling up to consistent group reporting.

Following the successful implementation of the RACA module, the company expanded the implementation to include incident management, key risk indicators, and action tracking. The integrated nature of our solution allowed for automatic linkage between incidents, risks, and controls, providing a comprehensive view of the risk landscape.

The incident management functionality was particularly impactful as the wide and diverse nature of the group meant that reporting of incidents was unstructured and difficult to quantify and track.

The implemented system was transformational and enabled a centralised view of incidents, with rapid response times and features such as root cause analysis and automated action plans

Contact us

"*" indicates required fields