EBA Report Highlights Urgency for IFRS 9 Compliance

In its latest monitoring of IFRS 9 implementation by EU institutions, the European Banking Authority (EBA) has underscored the crucial need to promptly address practices that deviate from expectations. Published on 17 November 2023, the report signals a forthcoming focus on IFRS 9 frameworks, practices, and tools during control inspections for all banks.

In this article, we will show you how to set up your IFRS 9 framework step by step in compliance with EBA requirements.

Step 1: SICR Deployment Excellence

Step 1: SICR Deployment Excellence

EBA issues

The continued lack of the use of collective SICR assessment, as required by IFRS 9, persists despite persistent macroeconomic uncertainties. Prudential concerns persist regarding practices employed to determine SICR thresholds that are not always in line with the main objectives of the impairment model of IFRS 9, and specifically, with the concept of ‘significance’ as envisaged in the Standard.

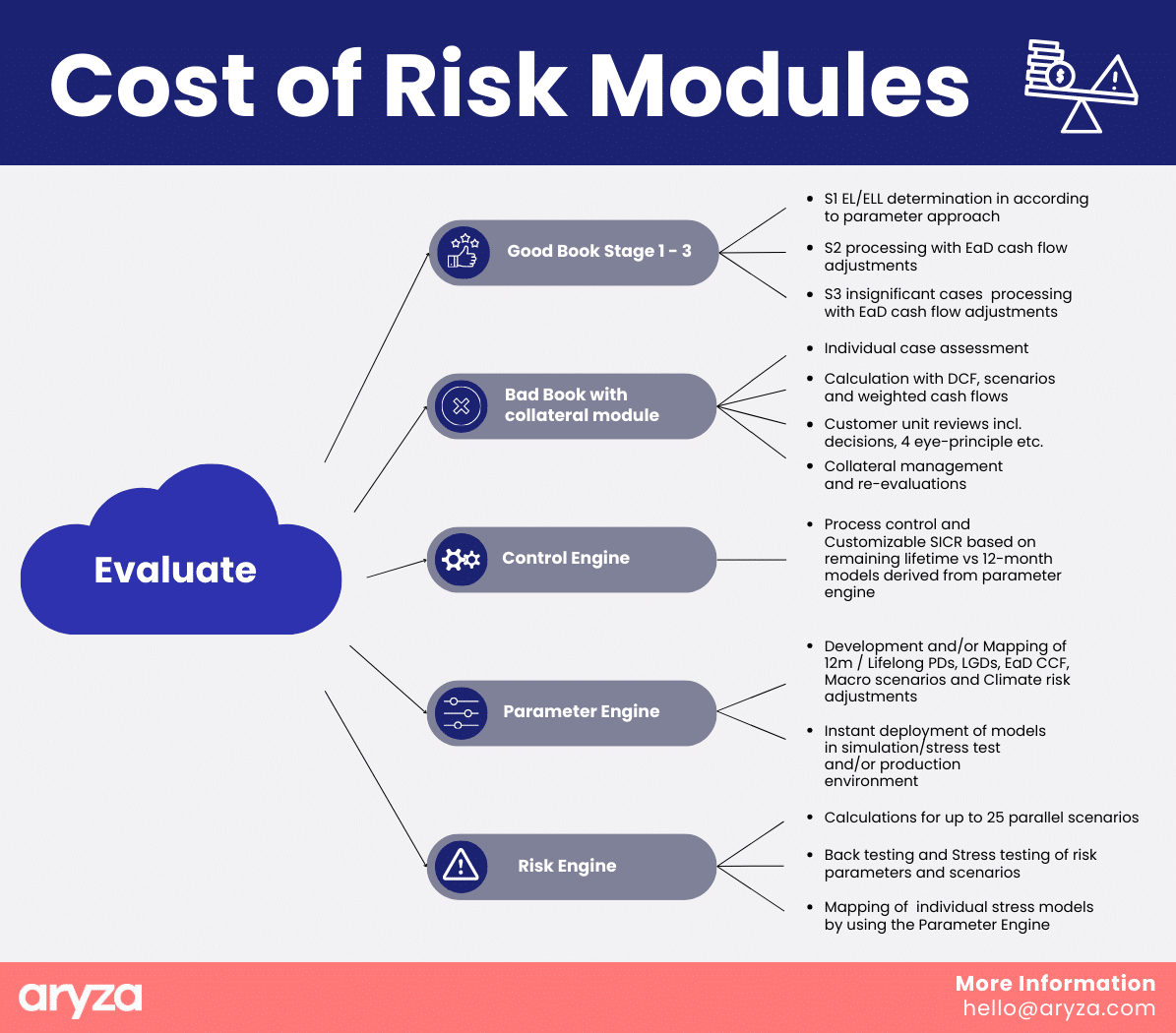

Evaluate solution

Our parameter engine supports the rapid deployment and updating of PD models. Together with the control engine, which allows for flexible setup of SICR rules, it enables banks to conduct SICR testing and analysis. This process ensures that the testing and achievement of Significance criteria can be confirmed, and appropriate SICR can be deployed.

For SICR backtesting, our simulation environment offers the benefit of testing SICR on historical portfolios, with the deployment of any new PD models to archived transactions. Additionally, any other rules for staging, both qualitative and quantitative, can be easily deployed at any time.

Step 2: Risk Assessment Findings

EBA issues

The analyses conducted in the realm of HDPs confirm the persistence of practices that can result in delays regarding transfers to Stage 2. Consequently, these practices might contribute to an increase in the variability of the final ECL outcomes among institutions.

Evaluate solution

Our control engine enables the setup of specific rules for particular segments or sub-segments of the portfolio. This allows exposures or portfolios classified as HDP to receive appropriate treatment in the stage allocation process, model coverage, and, ultimately, in the provision process.

Step 3: Enhanced SICR Measures

Step 3: Enhanced SICR Measures

EBA issues

Institutions are expected not to rely too extensively on a specific trigger for staging assessment alone but to have in place an adequate set of qualitative and quantitative indicators for SICR purposes. Additionally, in line with the practice already implemented by many institutions in the sample, it is expected that institutions use a threefold increase in the (annualized) lifetime PD as a backstop indicator for determining SICR.

Evaluate solution

Our parameter engine facilitates the swift deployment and updates of PD models. Alongside the control engine, providing a flexible configuration of SICR rules, it aids banks in conducting SICR testing and analysis. This guarantees the validation of Significance criteria and the implementation of suitable SICR.

In SICR backtesting, our simulation environment provides the advantage of testing on historical portfolios by deploying any new PD models to archived transactions. Moreover, rules for staging, encompassing both qualitative and quantitative aspects, can be effortlessly implemented at any given time.

Step 4: Diverse Overlay Practices

Step 4: Diverse Overlay Practices

EBA issues

Institutions continue to make extensive use of overlays, but various practices are observed. Their calibration often relies on a high degree of judgment, highlighting the importance for institutions to follow sound methodological approaches supported by appropriate governance processes.

Evaluate solution

We support the deployment of overlays on the transactional level, but we can also deploy them for any segment or subsegment of the portfolio. Furthermore, we enable the tracking of deployed overlays, and we have an approval process in place for overlays. This ensures a sound governance process when it comes to the deployment of such management adjustments.

Step 5: Unified IFRS 9

Step 5: Unified IFRS 9

EBA issues

One key finding in this area is related to the approach taken by some institutions that have not developed targeted IFRS 9 models for certain portfolios. For those institutions, data shows that Expected Credit Losses (ECLs) are determined by applying the same level of loan loss provisions as those used for other portfolios where IFRS 9 models have been applied.

Evaluate solution

We can support the development and deployment of models for any segment and subsegment. In cases where there is a lack of modeling data availability, we can easily track the performance of the observed portfolio and provide a back-test function for selected exposures in order to validate the model replacement process of the bank.

Step 6: ECL Framework Overlays

Step 6: ECL Framework Overlays

EBA issues

Overlays have become an integral part of the ECL framework, and it is expected that this would remain the case. Some overlays are more temporary in nature, while others are more permanent, pending structural model changes. This consideration reinforces the need for institutions to follow a structured approach when overlays are used for loss provisioning purposes.

As already stated in the last EBA risk assessment report (13), while it is acknowledged that these overlays may be necessary to timely account for specific circumstances that cannot be immediately embedded in the ECL model assumptions, it is expected that their usage falls under a robust methodological framework, strict governance processes, and internal controls. Additionally, the nature, significance, and permanence or expected duration of the adjustments should be well understood by all parties concerned.

Evaluate solution

We support the deployment of overlays on the transactional level, but we can also deploy them for any segment or subsegment of the portfolio. Furthermore, we enable the tracking of deployed overlays, and we have an approval process in place for overlays. This ensures a sound governance process when it comes to the deployment of such management adjustments.

Step 7: ESG Integration

Step 7: ESG Integration

EBA issues

Finally, very few institutions have considered climate and sustainability-related risks in their ECL models, although they are considered to be material.

Evaluate solution

We can easily integrate the marking of specific portfolio characteristics, such as ESG, within our tool. This enables a more specific treatment of such exposures within the provision process, whether specific models are needed for these exposures, the staging is unique, or management overlays have to be deployed. Additionally, within our parameter engine, we can develop and deploy models that integrate specific ESG risk characteristics based on the bank’s requirements.

Step 8: IFRS 9 Sensitivities

Step 8: IFRS 9 Sensitivities

EBA issues

The impact of forward-looking information and non-linearity effects is confirmed to be generally modest, but divergent practices may explain different sensitivities observed across institutions. Some smoothing practices may prevent the reflection of the point-in-time and forward-looking nature of IFRS 9 figures.

Evaluate solution

Our parameter engine can easily deploy new macroeconomic scenarios and test their effects on provision and staging. The process of model update and lifelong model vectors is automated, allowing such exercises to be executed in the shortest possible time. This includes the simulation test of the effects of desired changes directly within the tool.

Step 9: Back Testing Challenges

Step 9: Back Testing Challenges

EBA issues

Most notably, it was observed that the effective use of back testing for the periodic review of the IFRS 9 models has been, so far, quite limited. Back testing results not often trigger concrete actions and model improvements, raising supervisory concerns.

Evaluate solution

Within our tool, we can deploy the back testing process in such a way that the performance of models can be tracked over time. Additionally, we can track any model changes used over time on a single transaction level. All details are archived and can be reused in a simulation environment, allowing the bank to track historical performance, perform recalculation based on alternative models, and deploy any desired back testing process with great flexibility in a user-friendly environment.

Step 10: IFRS 9 Back Testing

Step 10: IFRS 9 Back Testing

EBA issues

It has also been observed that some institutions are lagging behind in developing back testing frameworks for IFRS 9. They have either not back-tested any parameters/risk factors yet or have limited back testing only to 12-month PD and/or LGD, while planning to develop and/or enlarge the scope of their back testing activities.

Evaluate solution

In addition to the above, within our tool, we easily support back testing of lifelong vectors used for stage 2 provision, as well as the adequacy of the calculated level of provisions.

Step 11: Back Testing Concerns

Step 11: Back Testing Concerns

EBA issues

The lack of proper follow-up actions on back testing results raises prudential concerns, especially when the tests performed reveal underperformance and low predictive powers of the model’s estimates. This might not ensure consistency in the reported ECL figures.

Evaluate solution

Specifically for stage 3 back testing, we have automated the process so that any identified deviations from expected vs. realized losses are escalated to desired levels. Such occurrences automatically prompt feedback and/or updates to deployed scenarios.