Advanced Solutions for Debt Recovery and Efficient Collection Processes

Aryza Collection Suite delivers advanced, cloud-based solutions for debt recovery and efficient collection processes. Leveraging automation and AI, it streamlines operations, enhances compliance, and accelerates collection success.

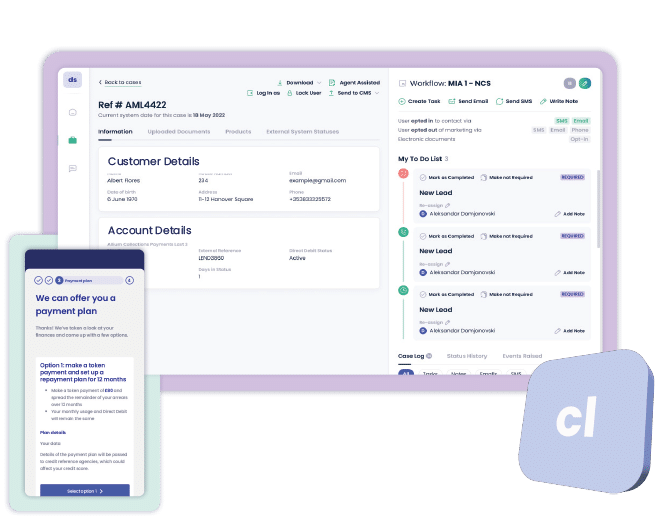

Automated, Multi Channel Debt Recovery

Aryza Collect enhances debt recovery by using automation, AI-driven segmentation, and customizable workflows. It engages customers, increases collection success rates and provides self-service portals for customer management.

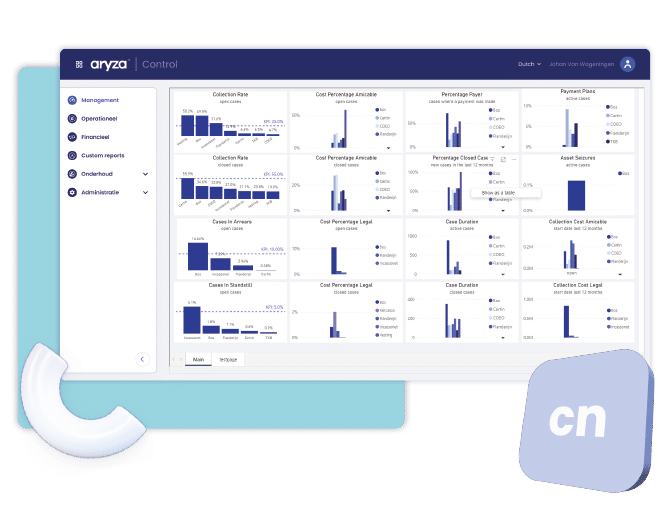

Debt Collection with DCA Benchmarking

Aryza Control provides a unified platform for managing debt collection, offering transparency and ensuring regulatory compliance.

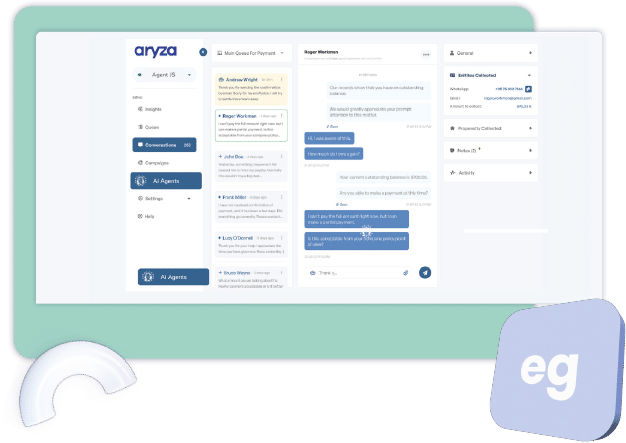

Conversational AI for Credit & Collections

Aryza Engage enables smarter, more efficient customer conversations through AI-powered messaging, automation, and omnichannel communication – fully compliant and easy to deploy.