Operational Risk: Turn Operational Risk into Business Value

Operational risk isn’t just about avoiding loss—it’s about gaining insight. By centralising data, automating analysis, and linking risk to strategy, organisations can uncover opportunities to improve performance, resilience, and compliance.

Speak to a member of the team to find out more about Aryza Unit

Enhance business performance

Operational risk data can be an incredibly rich source of insight for financial services firms who understand what information to gather and how to probe it. So, having the right technology in place to support GRC intelligence is essential. Aryza Unite – Operational Risk enables firms to collect, analyse and share this information – helping the business understand how it can be more efficient and effective, to deliver more value.

Understand operational risk

Enriched with operational risk industry expertise over 15 years, Aryza Unite – Operational Risk is a solution developed through partnership with best practices in mind. Used by more than 85 financial organisations around the globe, it has been voted best-in-class for operational risk software by independent industry analysts.

Aryza Unite helps firms to:

Centralise Risk Data

Put Risk Appetite into Practice

Log and Analyse Loss Events

Track Key Indicators Proactively

Optimise RCSAs

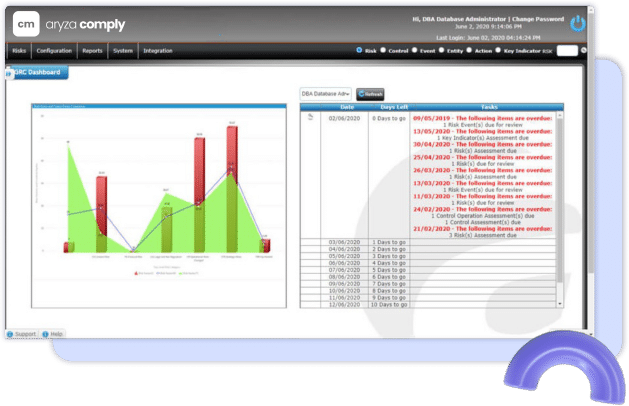

Visualise Operational Risk

Enable Scenario and Capital Analysis

Contact us

"*" indicates required fields