Snap Finance transforms customer collections with conversational messaging

Snap Finance is a UK-based provider of point-of-sale finance solutions, helping customers spread the cost of purchases through flexible repayment plans. With a focus on responsible lending and inclusive access to credit, Snap serves a wide range of customers and retail partners across the UK.

THE BUSINESS CHALLENGE

Snap Finance, one of the UK’s fastest growing consumer credit companies relied heavily on phone calls to engage with customers with many implementing various tactics to avoid taking calls.

This resulted in higher contact costs and agent resources required to collect payments and hampered the business’ ability to scale and meet growth targets.

HOW ARYZA ENGAGE HELPED

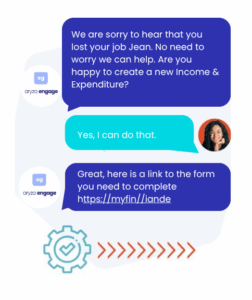

A conversational message solution was designed to eliminate customer pressure to talk with agents, giving customers the ability to engage in a less intrusive manner.

Conversational Automation

Adding ‘I&E’ and ‘Change of Circumstances’ conversational form functionality enabled agents to send conversational forms during a messaging conversation. Customers have the option to discuss payment plans and fill out required forms. Agents are now only calling to customers they need to, with home visits being shorter and less costly.

Rapid Agent Deployment, Zero Downtime

Aryza Engage was highly effective during emergencies. Getting agents working remotely, creating/deploying a proactive ‘Repayment- AI Agents’ to manage thousands of payment reductions and holiday requests. Designed to ascertain if customers’ income was reduced and worded empathetically, the AI agent guided customers through an ID&V process determining ability-to-pay and if a holiday was required, then scheduling an agent-call.

Aryza Engage’s conversational messaging now plays a primary role in our customer contact strategy deploying before dialler campaigns and field visits and it really works!

Jonathan Booker| Head of Field Collections