Facilitates easy digital interaction between creditors and insolvency practitioners

An intelligent two-way, FCA Approved communication platform

Aryza Connect is unique in the insolvency space as the only two-way automated communication platform.

Communicate and share information directly between Creditors and Insolvency Practitioners with the touch of a button.

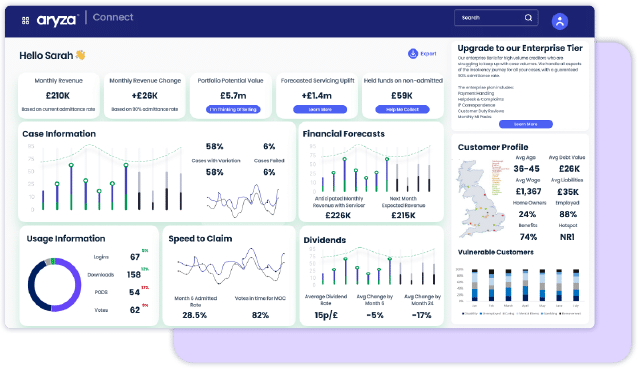

Aryza Connect for Insolvency Practitioners

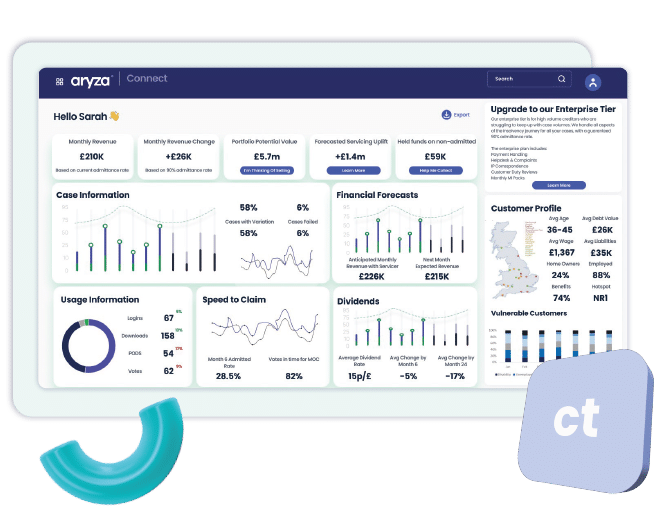

Aryza Connect for Creditors

For Insolvency Practitioners

Aryza Connect allows you to manage insolvency communications with creditors, all seamlessly integrated with your Aryza case management platform.

Our intelligent two-way, FCA Approved communication platform offers incredible benefits

Aryza Connect is uniquely placed in the market, offering two-way automated communication between Insolvency Practitioners and Creditors. Whilst there are other portals available on the market, they don’t offer the same two-way communication available via Aryza Connect.

A secure environment

A secure environment

Effective communications

Effective communications

Dedicated support team

Dedicated support team

Increases efficiency

Increases efficiency

Electronic by design

Electronic by design

Time-saving

Time-saving

Enhanced communication with creditors

Enhanced communication with creditors

Faster delivery

Faster delivery

Compliance and customer care

Compliance and customer care

Improved performance

Improved performance

Aryza Connect a new approach for the insolvency industry

97%

Creditors engage with Aryza Connect

12,670

Creditors available online

50

Brands working with Aryza Connect

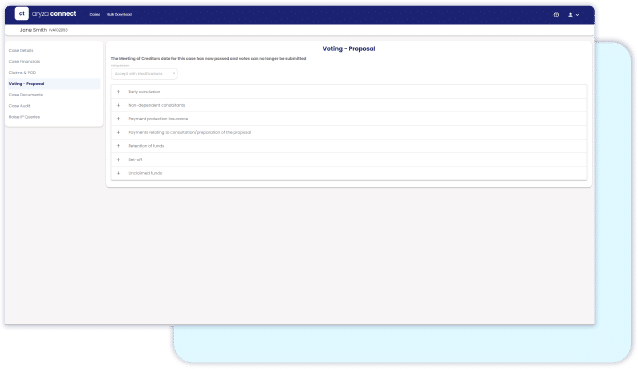

For Creditors

Aryza Connect allows you to manage voting and proof of debt submissions through a user-friendly portal or automate processes as part of our light-touch managed service offering.

Maximise return whilst minimising risk and effort across your insolvent portfolio

A software driven servicing solution to help you manage your insolvent portfolio. By leveraging over 20+ years of expertise and experience managing £17bn+ using our proprietary systems, we understand the challenges and time taken to manage insolvencies. Our platform enables you to self-serve cases or trigger automated voting and proof of debt submission to streamline your operations.

Timesaving

Timesaving

Expertise and accuracy

Expertise and accuracy

Automation

Automation

Document Management

Document Management

Audit

Audit

Revenue generation

Revenue generation

Enhanced efficiency

Enhanced efficiency

Confidentiality and compliance

Confidentiality and compliance

Aryza Connect brings great efficiencies to creditors

65,000+

votes processed through Aryza Connect

300+

hours saved for creditors per month through automation

2.5m+

claims on platform

Interested in a full managed service to manage your entire insolvency portfolio? At Aryza Evolve, we have over 2 decades of experience in managing all aspects of personal insolvency. Our managed service offering covers the entire Insolvency Practitioner Market, with a proven 95% admittance rate for our clients.

Contact us

"*" indicates required fields