Smarter Lending, Stronger Recovery

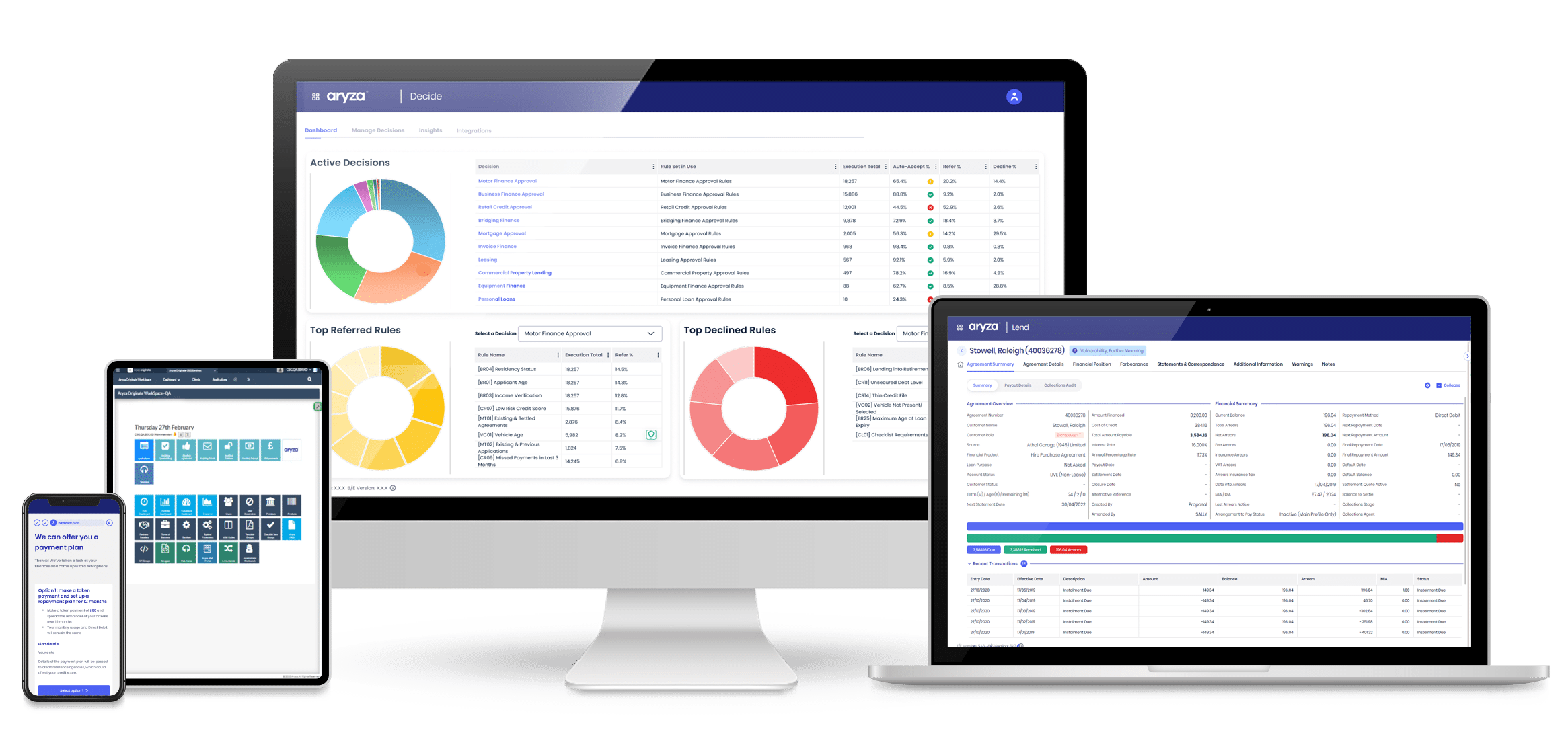

Aryza Lend – Manage Your Loan Book Intelligently

Aryza Lend helps Vanquis to manage repayment journeys more proactively. With configurable business rules and embedded affordability assessments, you can treat customers fairly while protecting your bottom line.

We understand the challenges you face and we believe Aryza can help you overcome them:

Vanquis challenge:

Increasing early-stage delinquency

Aryza Lend helps reduce early arrears by proactively managing customer journeys from day one. With real-time affordability checks and configurable repayment strategies, it ensures customers are supported before accounts begin to deteriorate.

Vanquis challenge:

Static repayment strategies

Unlike rigid legacy systems, Aryza Lend offers dynamic, rule-based repayment plans that adapt based on customer behaviour, risk profile, or engagement levels. This flexibility allows Vanquis to tailor strategies that maximise recovery while staying compliant.

Vanquis challenge:

Limited flexibility in live account treatment

Aryza Lend integrates easily with existing loan systems and enables rapid deployment of new repayment paths, forbearance policies, or communication workflows. It puts control in Vanquis’ hands to adjust treatments without lengthy reengineering or IT dependency.

Speak to a member of the team to find out more about Aryza Lending Solutions

Aryza lending solutions

Aryza has a rich heritage of working with lenders and brokers to deliver award winning automation for all aspects of loan servicing.

£7Bn

of live lending managed by Aryza systems

196

lending brands currently supported by Aryza systems

c£120M

payments processed each month by Aryza systems

Contact us

"*" indicates required fields