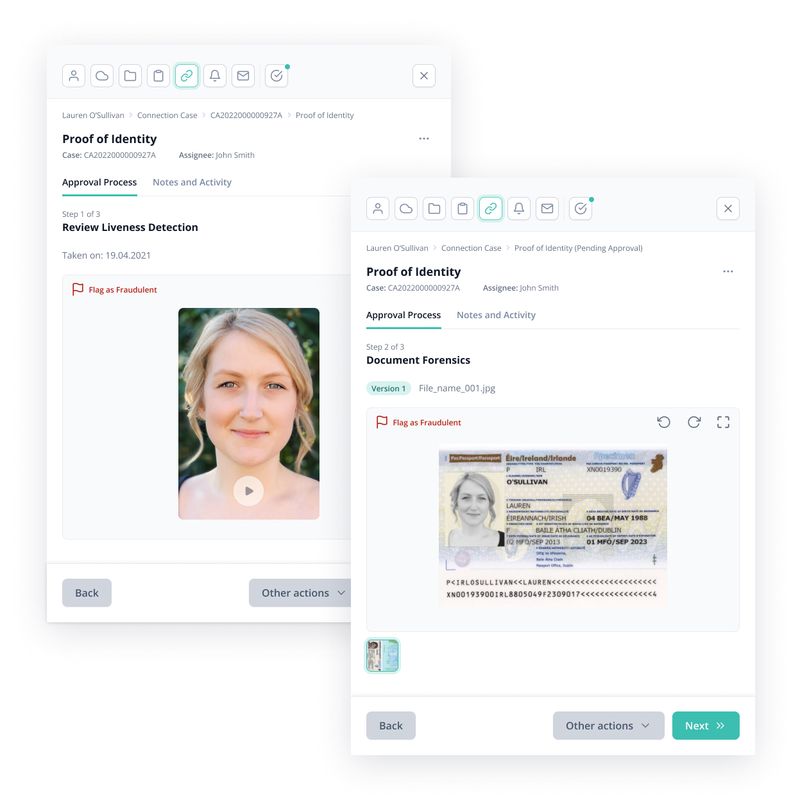

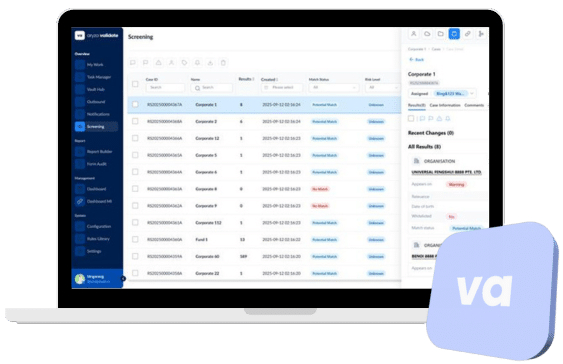

Digital Identity Verification & Onboarding Lifecycle Platform

Automate frictionless KYC and robust AML compliance across the client and counterparty lifecycle with a scalable, dynamic solution.

Speak to a member of the team to find out more about Aryza Validate

Smart, scalable KYC & AML compliance

Onboard clients and counterparties faster with a fully digital, reusable identity platform that delivers perpetual KYC, streamlined due diligence, and intelligent risk management. Aryza Validate is built to meet the compliance, transparency, and efficiency needs of today’s global institutions – all in one secure, cloud-hosted solution.

Aryza Validate helps regulated firms reduce onboarding times, improve client experiences, and stay fully compliant with evolving AML and KYC regulations.

Frictionless digital onboarding

Improved client satisfaction

Cost reduction

Simplified compliance reporting

Enhanced due diligence automation

Reusable digital identity

Perpetual KYC

Full global coverage

FinCrime screening

Secure digital vault

Aryza Validate in numbers

12,000+

supported document templates

248

countries and territories covered

90%

faster onboarding times compared to traditional processes

60%

reduction in manual compliance effort

Use Cases

FAQ

Aryza Validate is ideal for regulated sectors such as banking, fund and asset management, securities lending, legal and accounting firms.

Unlike traditional KYC platforms, Aryza Validate offers reusable digital identities and perpetual compliance, reducing friction, duplication, and time-to-revenue.

The platform supports identity verification and document templates in 248 countries and territories, with automated workflows and multilingual support.

Yes, Aryza Validate is built with open architecture and APIs for easy integration into your existing compliance, CRM, and onboarding platforms.

Contact us

"*" indicates required fields