GoCardless & Aryza – A New Era of Payments

Some of the biggest pain points faced by businesses can be solved through payments technology. From unpredictable cash flow, to wasted time and money, and even strained customer relationships. We have partnered with GoCardless, a global leader in bank payment solutions, to tackle these challenges together and enhance the payment capabilities across all platforms.

Through this partnership, you can now collect payments directly from your customer’s bank accounts via bank debit payments. In the UK, that’s Bacs Direct Debit and in Ireland, SEPA Direct Debit.

Benefits reflected in numbers

85%

of SMEs spend less time chasing payments

56%

saved on every transaction

59%

less time spent on admin

47%

faster payments

Experience the Synergy of Aryza & GoCardless

Challenges the GoCardless & Aryza partnership addresses…

Challenge 1:

Inefficient and outdated payment processes

Many businesses and consumers struggle with late payments, manual processing, and high transaction costs.

By integrating GoCardless’ advanced bank payment solutions into Aryza’s platform, the collaboration streamlines payment collection, reduces administrative burdens, and improves cash flow, enabling businesses to operate more efficiently and ensuring consumers can manage their payments more effectively.

Challenge 2:

Slow and costly one-off payment processing

Reliance on traditional card transactions comes with high fees and delays in fund settlement.

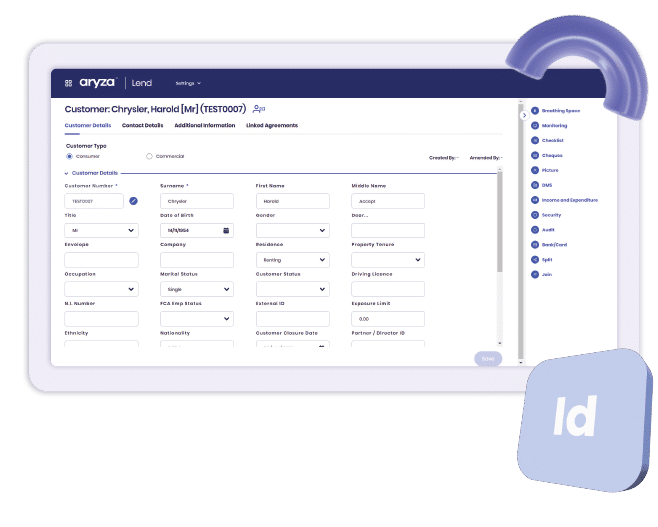

GoCardless’ open banking-powered Instant Bank Pay (IBP) integration into Aryza Lend, enable merchants to gain access to a faster, cost-effective alternative for one-off payments. This enhances cash flow, reduces transaction costs, and improves the overall payment experience for businesses and their customers.

Challenge 3:

Failed payments and revenue loss

Payment failures can disrupt cash flow, create additional administrative burdens, and strain customer relationships.

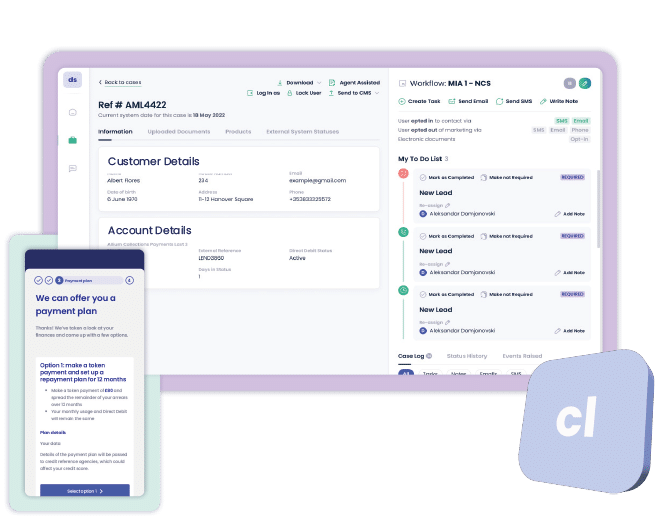

GoCardless’ Success+ tool allow Aryza’s merchants to automatically optimise payment retries, increasing success rates and reducing the need for manual follow-ups. This helps businesses improve financial stability, save time on payment recovery, and enhance the customer payment experience.

Challenge 4:

Complex global payment processing

Businesses operating across multiple regions often face complexities in managing cross-border transactions, dealing with different payment methods, and handling high fees.

By rolling out GoCardless’ Direct Debit and Instant Bank Pay (IBP) solutions globally, Aryza enables businesses to streamline payment collection, reduce costs, and offer a seamless, consistent payment experience across Europe, Australia, New Zealand, and North America.

Our products

We think we are a great fit, so we’d love the opportunity to talk

Contact us today to see how our synergy can transform your payment processes

"*" indicates required fields