The only end-to-end fund & counterparty onboarding solution.

Through our partnership with EquiLend, Onboard+ combines a secure platform for the exchange of sensitive customer information with a configurable dashboard that provides advanced fund analytics and onboarding progress tracking.

Onboard+: Unlock trapped liquidity

Connectivity

Simplified connectivity and access by leveraging existing industry-standard ALD file protocols. Also, support for Front Office and Onboarding Teams to access relevant progress updates and fund enablement priority.

Fund Onboarding

Too often, the process of onboarding funds and capturing the required data sets can be laborious and frustrating. Significantly reduce this time thanks to our future-proof platform.

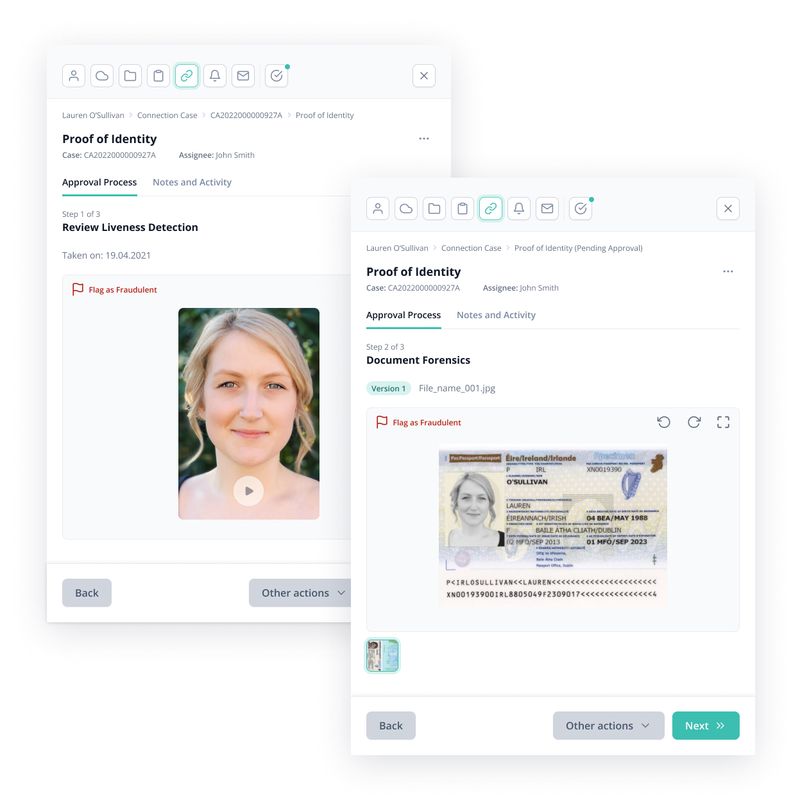

Workflow Experience

Discover a true end-to-end workflow experience that is designed specifically for the securities lending market, incorporating industry specific use-cases, resulting in a much-improved onboarding process.

Increased Transparency

Our solution offers true visibility and transparency to Lending Agents, reducing the need for manual chasing and difficult to track email trails and giving you more time to focus on revenue generation.

Onboard+ is a unique solution for Lenders and Borrowers

For Agent Lenders

- Streamlines the provision of beneficial owner information required by borrowers.

- Provides a secure channel for the exchange of sensitive information.

- Dramatically speeds up the time to market for new beneficial owners.

- Monitors the progress of onboarding by borrowers.

For Borrowers

- Provides secure access to beneficial owner information required for onboarding.

- Access to a configurable dashboard providing anonymized portfolio analysis and tailored search functionality.

- Matching of borrowing needs to new supply.

- Prioritize new beneficial owners for onboarding at the click of a button.

Unlock trapped liquidity.

Typical pain-points created by legacy systems can be removed by our award-winning onboarding platform. Automation of the onboarding process leads to reduced risk and an unlocking of trapped liquidity in the market.

Some of our numbers

95%

Customer satisfaction

12k

Monthly document checks

90%

Onboarding time reduction

50%

Onboarding cost reduction

Use Cases

Get in touch

"*" indicates required fields