Award-winning KYC & AML Compliance Solution for Law Firms

Significantly reduce time spent onboarding clients whilst generating a more accurate profile of them. We understand the unique challenges faced by law firms and offer a tailored solution to navigate this complex landscape with confidence.

The onboarding solution for the Legal industry

Proactive Alerts and Monitoring

Our platform will automatically notify you when documents are nearing expiry meaning you’re proactive instead of reactive.

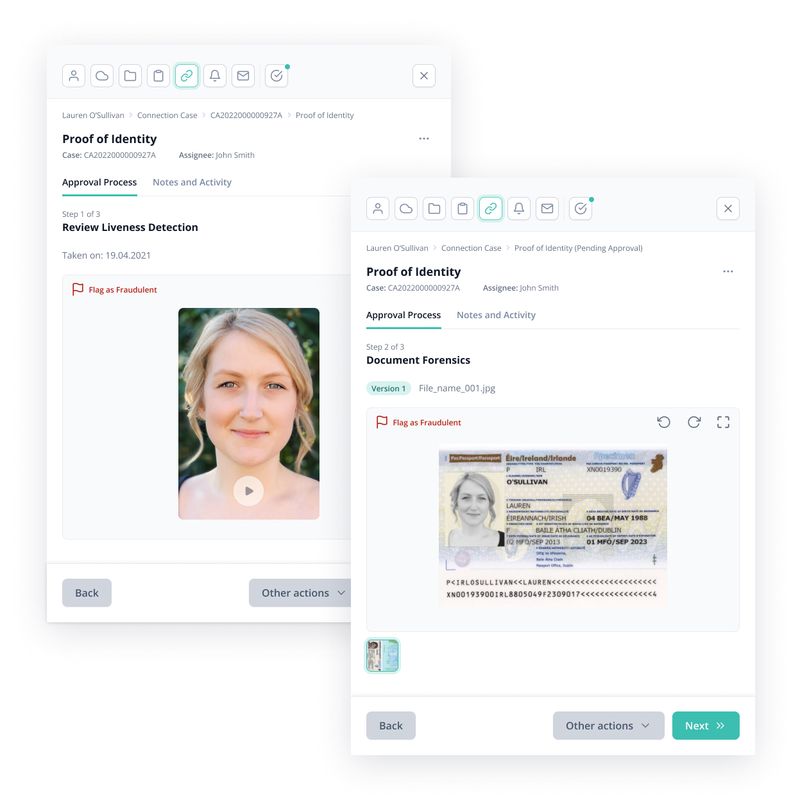

Verify Documents Instantly

Automate the document verification process with our platform that uses best-in-class technology. Time spent on matters will significantly decrease.

Corporate & Individual

Our platform can cater for everyone from a single contact to a large organisation simplifying every interaction for your firm.

Reduced Interactions, Improved Experience

Clients expect a premium service, and you can provide them with one by using our platform to do the work for you.

How Aryza Validate can improve your AML & KYC processes

AML Remediation

Correctly managing hundreds, or thousands, of client records and documents can be challenging and intensive on staff and a firm’s resources. We can correctly guide you to update and organise your data and to regain full control.

Our comprehensive KYC solutions address any identified weaknesses, equipping law firms with the necessary tools to perform thorough client due diligence and continuous risk assessments.

Client Risk Assessment

Increasing amounts of regulation has led to a significant uptick in the workload for legal firms. This work is crucial, but time-consuming. Our Risk Assessment software will give you the ability to make informed client decisions on and reduce time spent per matter.

Aryza Validate is committed to ensuring that law firms can confidently manage their KYC and AML compliance requirements. By partnering with us, you gain access to a solution that facilitates compliance, enhances risk management, and protects the firm’s reputation. Our platform offers a seamless experience for your clients while maintaining the highest standards of data security and privacy.

Client Onboarding

Whether it’s a single individual or an enterprise client, our onboarding platform can cater to your requirements. Automating this process with Aryza Validate will lead to improved data quality, fraud prevention, and significant reduction in onboarding times and identity verification.

Aryza Validate leverages advanced technology to automate the collection and and verification of client information, perform dynamic risk assessments, and enable real-time monitoring.

Aryza Validate in numbers

12,000+

supported document templates

248

countries and territories covered

90%

faster onboarding times compared to traditional processes

60%

reduction in manual compliance effort

Use Cases

FAQ

AML/KYC compliance is crucial for law firms to verify the identity of their clients, mitigate financial risks, and prevent the firm from being used for money laundering or financing terrorism. It ensures that law firms maintain the integrity of the legal and financial systems.

Technology can automate the collection and verification of client information, assess risks, and monitor activities, making KYC checks more efficient, accurate, and secure. This also helps in highlighting patterns and links that might not be immediately apparent, aiding in the detection of suspicious activities.

Non-compliance can lead to significant fines, reputational damage, legal action, and the undermining of trust in the legal sector. It’s essential for law firms to have robust AML and KYC programs to avoid these risks.

Law firms can strengthen their processes by implementing a risk-based approach, conducting detailed due diligence, monitoring red flags for money laundering, and screening clients against global PEP and sanctions lists. Utilising Aryza Validate’s services can ensure these measures are executed efficiently.

A comprehensive process for law firms includes Customer Identification Program (CIP), Customer Due Diligence (CDD), and Ongoing Monitoring. These components help verify client information, assess risk profiles, and monitor client transactions over time.

Law firms may struggle with maintaining up-to-date risk management strategies, ensuring staff adherence to risk policies, identifying Ultimate Beneficial Owners (UBOs), and managing ongoing relationships with clients. Aryza Validate’s solutions are designed to mitigate these challenges effectively.

Yes, Aryza Validate’s platform is adaptable and compliant with a range of global AML regulations, enabling law firms to meet their legal obligations in various jurisdictions effectively.

Aryza Validate adheres to strict data protection standards, such as GDPR, and uses secure protocols to manage sensitive information throughout the KYC process. Our platform ensures that client data is handled with the highest level of security and privacy.

Get in touch

"*" indicates required fields