AML & KYC Compliance: Reduce costs & optimise onboarding

Our onboarding and due diligence platform is a comprehensive solution to ensure integrity and trust in your enterprise.

The AML compliance solution for the Accounting & Professional Services industry

Significantly reduce onboarding times

Onboard your customers in minutes, not days. Save time, money, and reduce friction in your business.

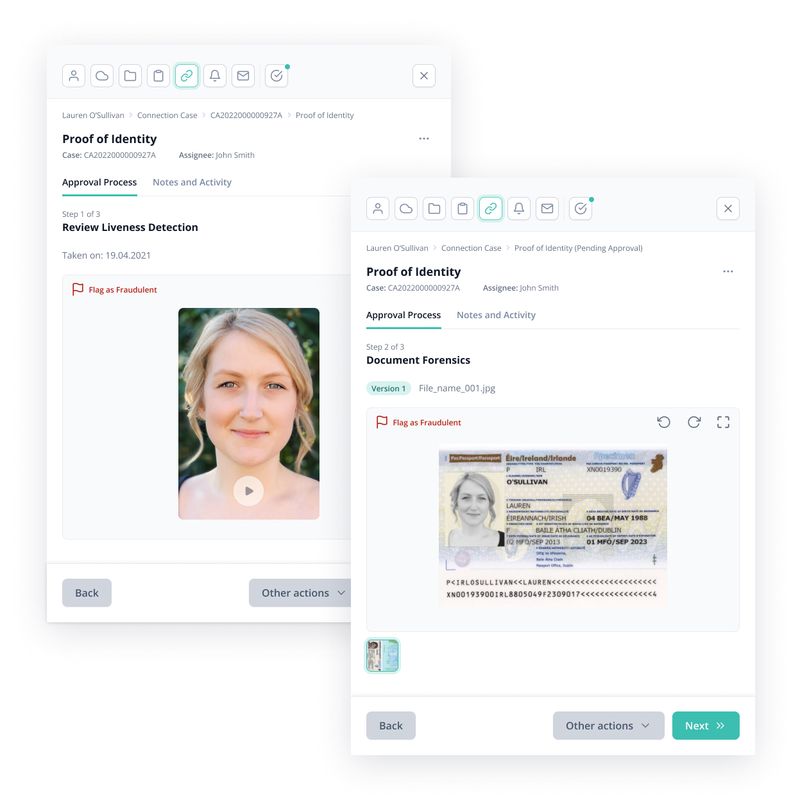

Improve document verification rates

Verify documents instantly and detect fake documents in real-time. 12,000+ documents listed.

Audit ready

Using our Audit Trail, you will be AML compliant and ready for inspection. Report on it in 5 clicks.

AML Compliance Obligations

Understanding and fulfilling your compliance obligations under AML/CFT Acts is crucial. Our platform equips you with the tools to assess risks, establish AML compliance plans, and carry out the necessary client verifications.

How Aryza Validate can help your firm

Instant digital verification

Automate KYC verification of sensitive client documents instantly. Enjoy significantly reduced onboarding times and turn onboarding into a competitive advantage.

Embrace the digital transformation with Aryza Validate’s advanced features. Our platform automates data collection, verification, and risk assessment, ensuring accuracy and efficiency in your KYC processes.

Document Storage and Security

Deliver perpetual KYC for your firm and remove repetitious actions. As the volume of documents being gathered by firms continues to grow, you can ensure your client’s data is secure and accessible.

KYC is not just a regulatory requirement but a critical component in building a transparent financial environment. For accountants and solicitors, this means conducting thorough due diligence on their clients to ensure the legitimacy of their financial activities and mitigate the risk of money laundering.

Reporting made easy

Give your firm the ability to generate detailed and customisable reports to make informed decisions. Success is defined differently by everyone, so you choose the reporting you need to meet your goals.

Aryza Validate is dedicated to supporting professional services in maintaining the highest standards of AML compliance. Our platform is designed to handle the complexities of KYC regulations, enabling you to focus on delivering an exceptional client experience with the assurance of AML compliance.

Aryza Validate in numbers

12,000+

supported document templates

248

countries and territories covered

90%

faster onboarding times compared to traditional processes

60%

reduction in manual compliance effort

Use Cases

FAQ

AML compliance refers to adhering to laws and regulations aimed at preventing money laundering and terrorist financing. For accountants, it’s crucial to ensure financial transactions are legitimate and to mitigate the risk of facilitating illegal activities.

AML compliance refers to adhering to laws and regulations aimed at preventing money laundering and terrorist financing. For accountants and legal firms, it’s crucial to ensure financial transactions are legitimate and to mitigate the risk of facilitating illegal activities.

Aryza Validate supports standard, simplified, and enhanced KYC verifications, catering to clients of varying risk levels, from basic identity verification to in-depth due diligence for high-risk clients.

The platform’s audit trail feature prepares your firm for inspections with comprehensive records of compliance activities, easily reportable in just a few clicks.

Yes, data security is a top priority for Aryza. We employ robust encryption and comply with international data protection standards to ensure the information collected during onboarding is secure.

By reducing manual entry, accelerating verification processes, and minimising wait times, Aryza Validate significantly improves the client’s onboarding experience, making it quick, user-friendly, and hassle-free.

Aryza Validate’s platform is designed to continuously monitor and notify you when client data needs updating, ensuring that your business stays aligned with the latest AML compliance requirements.

Yes, Aryza Validate is built for seamless integration, capable of working with your existing CRM, ERP, and other business systems, ensuring a smooth transition and minimal disruption.

Aryza Validate’s scalable platform is ideal for medium to enterprise-sized firms.

Aryza Validate’s scalable platform is ideal for small to medium practices and large enterprises, ensuring that firms of all sizes can benefit from efficient AML compliance and KYC processes.

Aryza Validate provides customizable reporting features, enabling firms to generate detailed reports for internal audits, compliance checks, and informed decision-making.

Get in touch

"*" indicates required fields