Aryza Credit Suite

Empower Your Lending Operations with Efficiency and Innovation

Aryza Credit Suite offers solutions for managing the loan lifecycle, from origination to risk management, all within a single platform. With cloud-based delivery, it empowers lenders to streamline processes, improve efficiency, and enhance compliance.

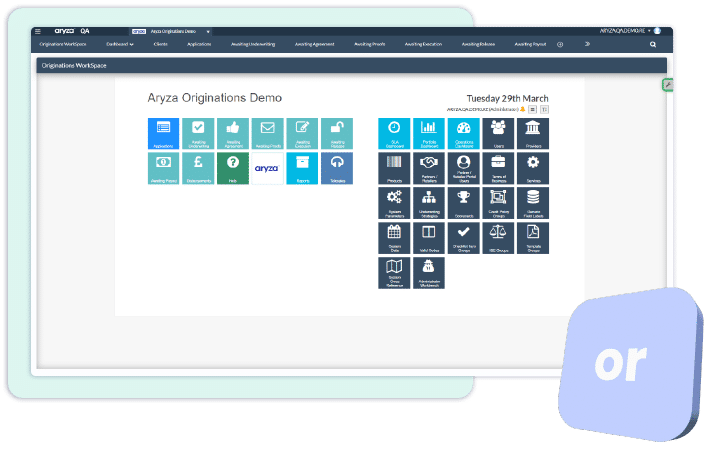

End-to-End Loan Origination

Aryza Originate simplifies the entire loan origination process for both consumer and commercial customers. It manages the complete lifecycle from quote and application to decision-making and loan execution.

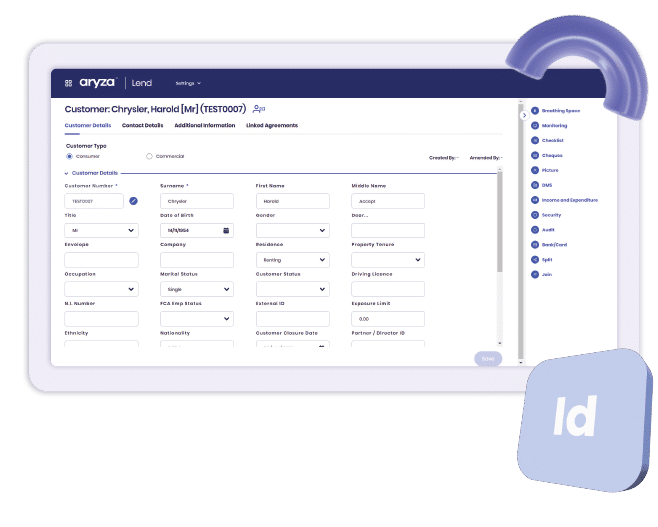

Flexible and Reliable Loan Processing

Aryza Lend offers automation for payment profiles and loan management, along with seamless integration with major credit bureaux and third-party systems.

Credit Risk Management and Compliance including IFRS9

Evaluate is designed for banks and financial institutions seeking a comprehensive risk management solution.