Aryza Asia Pacific

Global SaaS solutions for businesses servicing customers at every stage of the credit cycle

Automation for credit, collections, recovery, GRC and debt.

Product Suites

Aryza provides SaaS solutions that automate financial processes and improve efficiency and compliance at all stages of the customer cycle

Discover our Product Suites

Credit Suite

Credit Suite

Lending solutions for onboarding and customer management

Collection Suite

Collection Suite

Collections and recovery solutions to streamline processes and enhance payment from indebted customers

Recovery Suite

Recovery Suite

Case management software for debt and insolvency

Debt Suite

Debt Suite

Our Debt Suite facilitates easy digital interaction between creditors and insolvency practitioners – also available as a managed service

Compliance Suite

Compliance Suite

Governance, Risk, and Compliance. Manage risks, meet industry and government regulations, operate more efficiently to take action faster

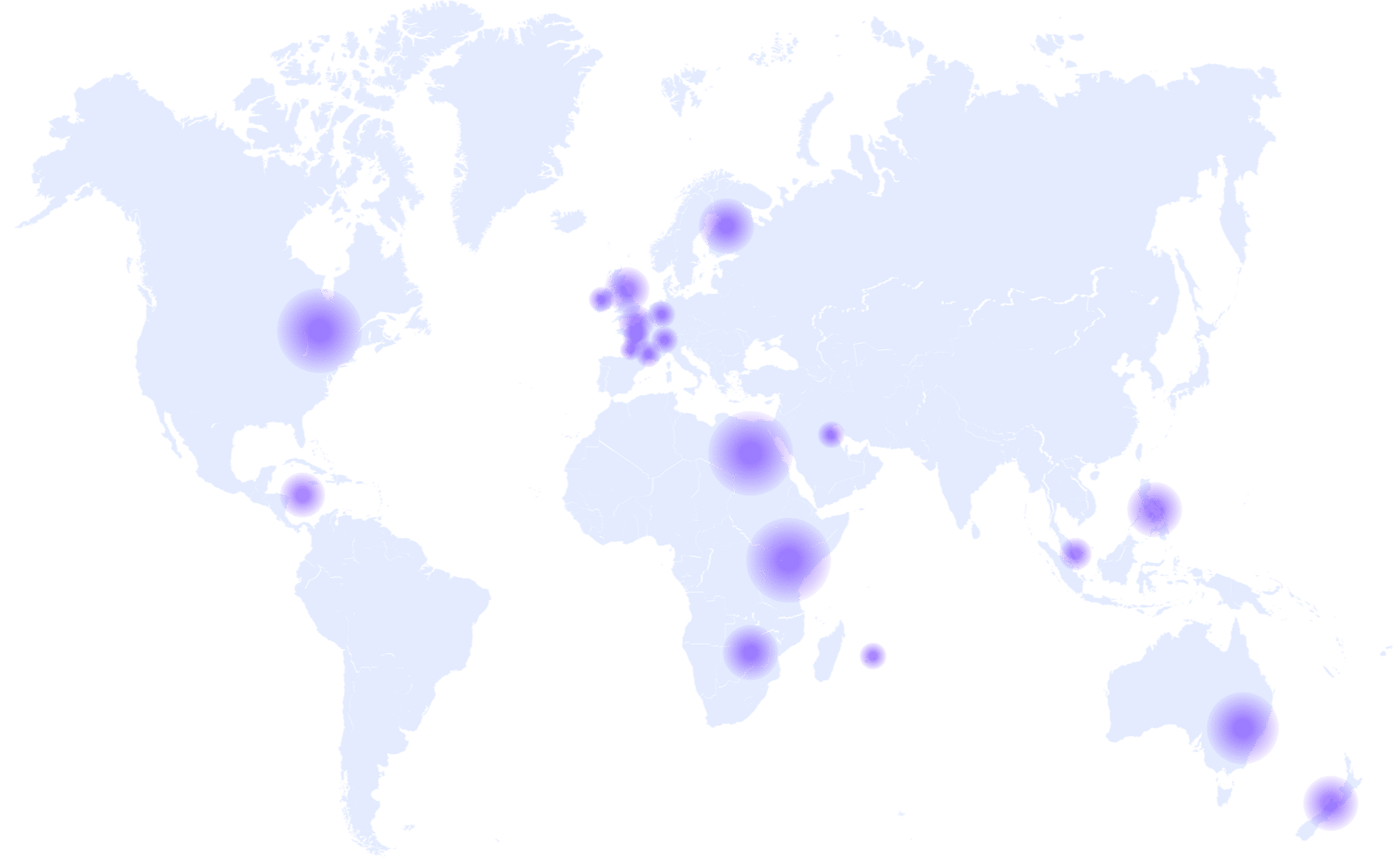

Our global network

In a short time we’ve built momentum, scale, capability, and diversity in our business

7

Products

1,650+

Clients

10m+

People helped

Since our inception in 2002, we now operate in 20+ countries