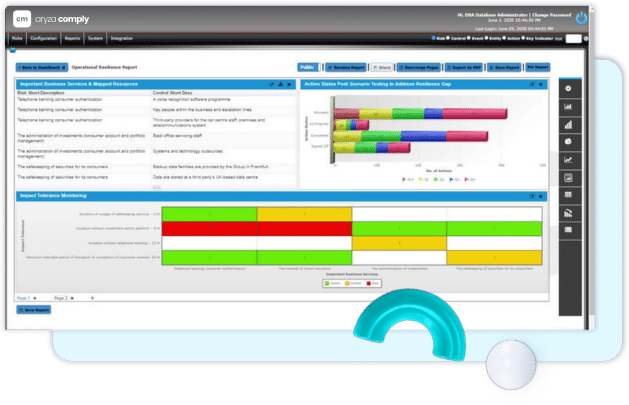

Operational Resilience: Build Resilience That Lasts

Operational resilience is more than recovery—it’s about readiness. By connecting risk, control, and business service data, organisations can make faster, better decisions in times of disruption, ensure compliance, and strengthen long-term stability.

Speak to a member of the team to find out more about Aryza Comply

Foster strength and agility

Today, the importance of a robust approach to operational resilience for financial services firms can be in no doubt. Aryza Comply – Operational Resilience enables organisations to connect their programmes directly to their operational risk, enterprise risk, and other GRC information. Data, actions and outcomes are understood in the context of the firm’s overall risk appetite and strategic goals. This enables faster decision-making in times of crisis, stronger resiliency, and ongoing regulatory compliance.

Improve operational resilience

For financial services firms, operational resilience is the ability to prevent, adapt, respond to, recover and learn from operational disruptions. Looked at another way, operational resilience is an outcome that a firm’s risk and control framework leads to. Aryza Comply’s connected approach to operational resilience enables firms to engage with the information needed to make the right decisions, to stay compliant and meet the business’s strategic goals in the face of a crisis.

Aryza Comply – Operational Resilience enables organisations to:

Centralise Business Services

Define Impact Tolerances

Monitor Service Disruption

Link Risks to Services

Take Action and Improve

Report Resilience Insights

Run Scenario Testing

Contact us

"*" geeft vereiste velden aan