Software for automating the Insolvency process

Aryza has a heritage in the debt management and insolvency sector, and over the past 20 plus years we have found ways to apply the latest technology to address many of the sector’s biggest challenges.

Insolvency applies to an individual or business that is unable to meet their financial obligations to lenders or creditors as debts become due. Typically before insolvency proceedings commence there is likely be an informal arrangements with creditors, such as setting up alternative payment arrangements.

Helping consumers and businesses when they are financially struggling

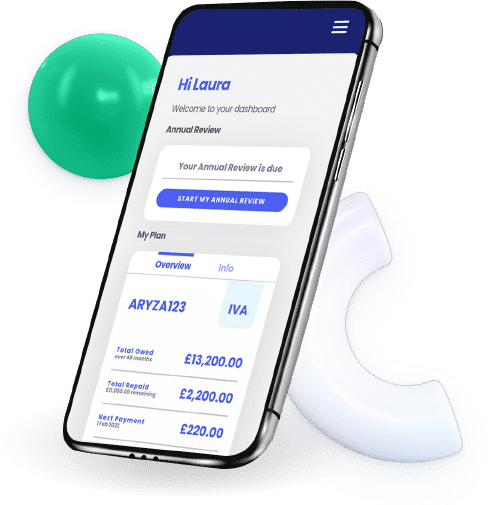

The challenges that insolvency practitioners and debt management providers face are mainly around the tight regulation that is in place to govern debt management and insolvency solutions. Aryza systems are able to automate the entire cycle of debt, from identifying customers that are vulnerable and struggling, to providing automated debt advice and the management of a case through to completion.

Our case management solutions are market leading and currently over 60% of monthly appointments in the UK personal insolvency sector are managed on Aryza insolvency software.