The next generation of corporate & personal insolvency case management software

Personal Insolvency

Corporate Insolvency

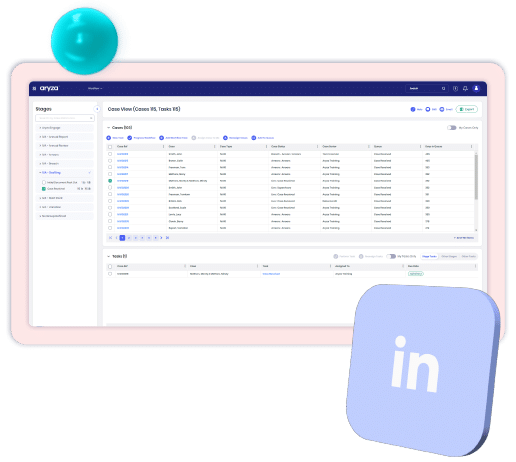

Aryza Insolv

Automation for case management in debt management and insolvency

Aryza has over 20 years’ experience in the insolvency and debt management sector, and it was one of the pioneers of introducing automation to the sector.

Aryza Insolv for personal insolvency and debt case management builds on this experience of systems, software, and best practice within the sector to deliver a truly global product that adapts to the regional requirements and local legislation in each area.

It embraces the challenges of managing customers from acquisition and onboarding, through data collection, advice and management and recording of financial transactions. All of this is in a secure, compliant, and reliable platform.

Aryza Insolv uses automation and integration to bring efficiency to the personal insolvency journey, checking affordability to ensure consumers are offered the best debt solution for their needs.

From lead generation through to signposting, Aryza Insolv offers consumers a simple user interface to help them access the support they need.

Automate your business with tools for customer onboarding and creditor engagement. Our award-winning software is ideal for companies in the debt & insolvency industry and beyond, including brokers, lenders, financial advisors, introducers, lead providers and more.

Reimagining the insolvency case management process – end to end IP software solution

Efficiency for your business and your customers

Efficiency for your business and your customers

Supporting the Insolvency Practitioner

Supporting the Insolvency Practitioner

Self serve to enhance communications

Self serve to enhance communications

Consistency and compliance

Consistency and compliance

Automated process and communications

Automated process and communications

Simple case management

Simple case management

Aryza Insolv

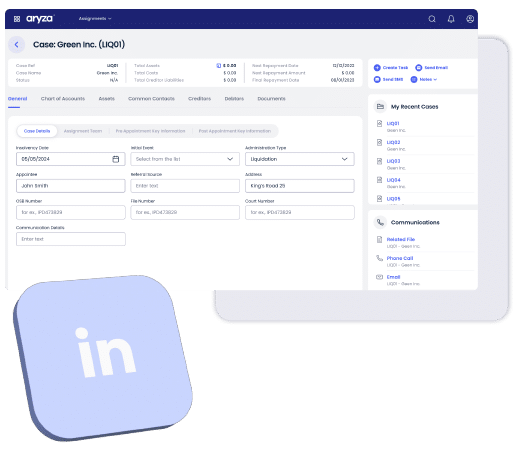

Automation for efficient corporate insolvency

As an insolvency professional, are high costs, increasing complexity, inefficient processes, and compliance concerns proving to be daily challenges?

Aryza Insolv our SaaS-based, cloud-hosted product uses high levels of automation. It will help you to standardise compliant processes and templates to meet all regulatory requirements. It will also allow management by exception to ensure your focus is always where it is most needed in an environment designed to create more engagement and a single source of truth.

Automate your business with tools for cost saving, faster case handling, and reduction in staffing costs. Aryza Insolv helps you to easily communicate with all case participants – creditors, employees, directors, debtors, and shareholders, improving engagement while cutting down on time and costs.

Committed to innovative and comprehensive solutions that streamline your processes while staying ahead of regulatory changes

Simple case management

SaaS Time & Disbursements

Document Packs

Flexible packages

Integrations

Ongoing support and training

Speak to a member of the team to find out more about Aryza Insolv

Did you know we also offer training on all major insolvency exams?

Contact us

"*" indicates required fields